Australians are well known for their affinity towards property. We seem to have an obsession with it, from television shows to investor portals to podcasts. Interestingly, 27% of Australian property is owned by investors by number, and 24% by value.

‘Mum and Dad’ investors make up a huge proportion of property investors and property investors provide the vast majority of housing in Australia.

“15.7% of taxpayers have an investment property, with an average of 1.28 rental properties per investor.” (Core Logic)

Yet it’s the number of multi-property investors that is intriguing.

A large proportion of investors stop at one property, and multiple property owners become very thin on the ground after one. The percentage of Australians who own six or more investment properties is a tiny 0.0068%.

So why do so few pursue a second investment property?

Taking a look at the statistics gives us an enormous clue.

“Most investors are likely to own a unit, with 48% of Australia’s apartment stock likely to be owned by an investor.”

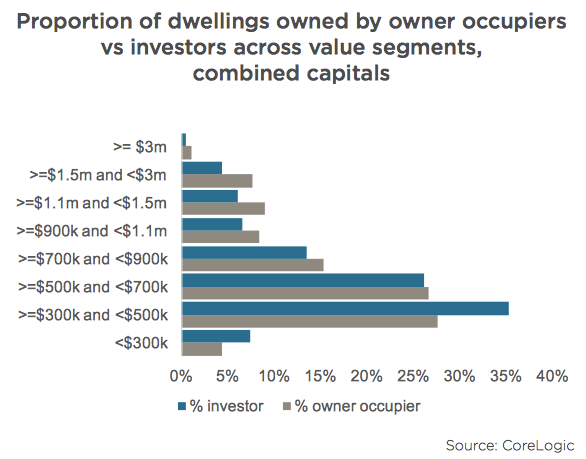

“Investment in Australian dwellings is generally skewed towards the lower value segments of the market.” (Core Logic)

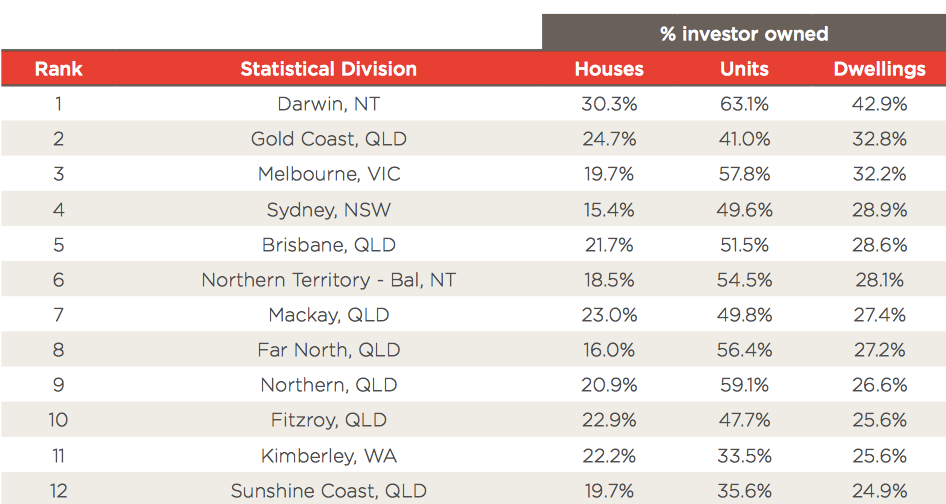

“The Gold Coast shows the second highest ranking for investment concentration nationally, with 32.8% of dwellings owned by investors.”

“Across the regional markets, the highest investment concentrations were generally located in the major regional centres associated with either lifestyle factors such as tourism and holiday homes, or locations more aligned with the mining and resources sector.” (Core Logic)

This chart below illustrates this point well. It is surprising to see that as a percentage of dwellings owned by investors, Darwin and Gold Coast trump Melbourne, Sydney and Brisbane.

It is little wonder so many investors stop at one investment property. Darwin has sustained some of the toughest market volatility and capital losses over the last decade.

Units in Queensland, (and specifically the Gold Coast) are in high supply and vacancy rates remain problematic for many investors who have bought into high density developments. Valuation shortfalls remain an issue for many who are facing imminent settlements, and APRA’s recent tightening on investment lending changed the landscape for many who had committed to off the plan purchases with longer sunsets on settlements.

Unit oversupply is not limited to Queensland. We have plenty of cities around our nation with an oversupply of units. Melbourne’s own Docklands, South Yarra and Prahran have been problematic for many investors over the past decade.

It is easy to recognise that for many who ‘dunk their toe’ into property investing, it’s not a pleasant adventure.

The four reasons why so many people have a horrible experience are:

- A silly motivation

- No planning

- Confusion around purpose

- Greed outweighing risk profile

A silly motivation is often triggered by an accountant. They advise the client to save some tax by investing in property. Many accountants out there favour a new property in an attempt to help their client maximise the available tax deductions via optimised depreciation. Little do they realise the asset will under-perform; with a low Land to Asset Ratio, and all of the disappointment an off the plan purchase can cause.

Tax deductions are great, but capital growth and solid rental performance is better.

Limited, or no planning can lead investors into strife. It is always amusing to compare the time and resources that consumers apply to planning a holiday or buying a car to investing in a property. For those who are lazy or disinterested, signing a contract in their local area, or worse still; purchasing an off the plan unit for haste can be a terrible idea. Many ‘investment property specialists’ provide a ‘free’ service to naive investors who are willing to buy property of a stock list. The free service from the ‘investment specialist’ is very costly, however. Developers and marketers pay up to 8% in commission payments to such salespeople, and this cost is directly built in to the over-inflated sales price.

Often lazy investors buy where they are familiar, i.e.. their own postcode. While this strategy isn’t necessarily a mistaken one, it certainly isn’t taking a broad approach. The investor may not have tailored their cashflow, budget and capital growth intentions well and the cost of a mistake could be a hard cost to bear.

Aside from stamp duty, agent’s selling fees, marketing costs and capital gains tax, a significant cost for many who decide to sell is lost opportunity cost.

The third reason is confusion around purpose. So many investors head into the journey with the intent to buy a property that they may one day use themselves for personal purposes. Whether it be a holiday house, a unit their kids may one day inhabit when they go to university, … the list goes on, this is not a pragmatic assignment.

The last reason is often the most dire. We’ve all read the stories about mining towns, boom-bust projects, horrific bank valuations and extended vacancy rates. Mining town investment has been a significant wealth-loss cause for many investors and sadly some have sustained more than just a financial burden.

Investors must accept that risk and reward go hand in hand. Targeting any residential property with huge and fast gains in mind carries enormous risk.

Stable, out-performing properties should be viewed with a long-term approach and for those expecting fast returns in a short period, this asset class may not be the right one.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU