There is plenty of talk about imminent interest rate rises, heightened petrol prices, inflation, Federal government budget decisions and the impact on the property market, but if we have learnt anything about forecasts and predictions over the last three years, we’ve seen that the banks and many economists’ forecasts haven’t really got it right.

Negative news stories are far easier to sell.

So, what is really happening out in the Victorian market?

Our pace of growth has slowed; in other words, we’re still running forward, but our acceleration has slowed. Our fastest growing month for the Victorian property market was back in the first half of 2021, however this is a hard measure to track because the Victorian market is made up of so many cities, towns, regions and dwelling types. Generalising the property market is so difficult to do, yet so many try to fit their property market descriptor into one, neat, short sentence.

Like always, our market has been dynamic and varied.

Over the past ten years, Melbourne apartments in general have underperformed houses, and to a significant degree. We have battled with oversupply, small, non-favourable securities, (ie. less than 50sqm floor size dwellings or commercially zoned residences), and more lately, a sudden drop off in overseas students and city travellers targeting short-stay apartments. COVID was really brutal for many Melburnians, including city apartment owners.

However, houses in inner-ring areas, middle ring locations, gentrifying suburbs and even many of our fringe locations fared reasonably well, (with the exception being many new ‘house and land’ dwellings). COVID exacerbated the growth of houses in our capital city. For the regions though, growth was significant in many regional cities for both houses and units. So many people flocked to the regions and the coast, seeking freedoms and lifestyle elements that Melbourne couldn’t offer for a long and difficult period.

Fast-forwarding the clock now, we can look back at the state and federal government incentives, the impact that working from home has had on us all, and the new ideals that many hold now that we’ve lived through a pandemic.

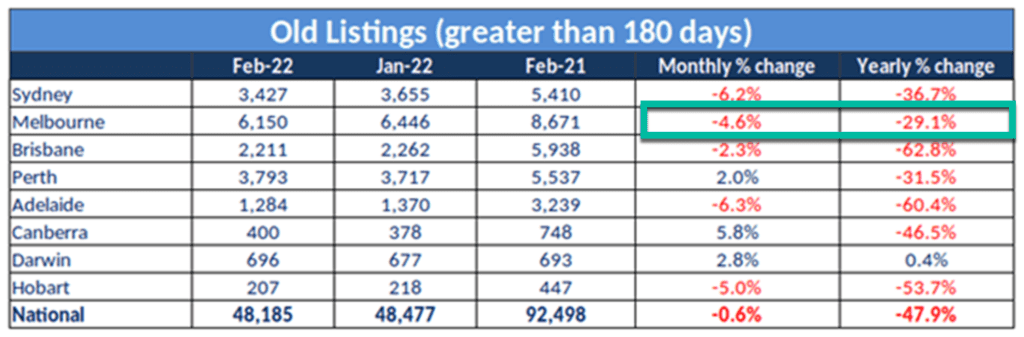

An interesting observation to make is that of old listings. An old listing is defined by a property that has been advertised on the market for 180 days or more. Many investors turned to selling when COVID hit and vacancy rates started to bite, and slowly but surely, these properties, (mostly made up of oversupplied apartments) sold. The interesting thing to note is that they sold to owner occupiers and ‘city pad’ buyers and many didn’t re-enter the rental pool. Our vacancy rates moved from woeful to tight within just one year, and our total stock on market illustrates what’s happened behind the scenes perfectly in this table.

Just when we thought we had some adjusting to take stock of, we now find ourselves paying over a hundred dollars to fill our tanks at the petrol bowser, and our newsfeed is full of disharmony around the globe, particularly in Ukraine and Russia. To add complexity to an already complex situation, we have our own local changes to factor in, such as:

- The impact of borders reopening; both to travellers and new arrivals/students,

- Record low interest rates amid a lot of speculation about an imminent rise, (as Josh Frydenberg said yesterday, “Monetary policy is the responsibility of the Reserve Bank. I don’t run a commentary on it other than to say interest rates are at historic lows.”

- A looming federal election, with limited proposals for tax reform or real estate legislative changes* (to date), and

- Tightening unemployment

- A return to the office for many workers

- Continued regional funding, decentralised employment, and incentives

At the coal face, auction clearance rates have eased slightly from what we’d call white hot conditions. It’s fair to say there is still heat in our seller’s market, but it’s not as difficult for buyers to navigate at present. More properties are passing in, (and selling shortly thereafter), less bidders are generally fighting it out at auction, and not every price is setting a new record.

However, the good properties are still attracting large bidder numbers, and these same properties are still breaking sales price records. The diversity of record results is far-reaching and seems to apply for a wide variety of dwelling types.

Take these campaigns, for example that we have participated in over this last week;

This stunning penthouse in the Arts Centre precinct went under the hammer on Wednesday night. Appraised based on square meterage rates and comparable sales around the $3M mark, and quoted at $2.6M – $2.8M, it sold for $4.33M, happily setting a new record based on size, condition and postcode.

Multiple bidders fought it out, demonstrating that the scarcity was highly prized and credit/funding was not overly concerning for them. Lenders are typically quite particular about high rise apartments and loan to value ratios, and clearly this apartment attracted some cashed up buyers.

Yesterday’s busy auction day started in Brunswick West, where ten people, (mostly first home buyers) registered to bid, and seven fought it out.

The property’s drawcard was a trifecta of things; a boutique block of just four dwellings, a short stroll to a local cafe and updated pub, and a sunny rear courtyard on title.

The following auction was in Lalor, just 17km from the city and home to some of the best home-produced Mediterranean deli-style produce. We’ve targeted this area as a gentrifying option for clients in the $700,000’s range and this property presented well internally, and also offered a large sunny yard, lock up garage, and friendly neighbourhood. Three of us fought for the keys on a long weekend Saturday; a testament to the growing popularity of the area.

The truth is that good properties are selling, compromised properties are passing in or facing discounting, and those vendors who are sitting on compromised assets and holding firm to 2021 market conditions are now having to face reality. Many agents are battling with overpriced stock, unreasonable vendors and C-grade off-markets that would likely fail at auction if tested in a typical advertising campaign.

It’s a sign of the times, but certainly not indicative of a falling market.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU