We have all seen and questioned this before; does the order of an auction have any impact, (positive or negative) on the outcome of the auction or the resultant sale price?

Auction television shows like “The Block” fuel conversation around this phenomenon, where viewers and participants alike wonder whether they are in a position of advantage or disadvantage when their auction is scheduled last.

Two forces are at play.

The first auction could surpass expectations and set a ceiling for the remaining auction items, where the strongest willing buyer’s maximum budget will not challenge any other of the remaining auctions. In other words, the strongest buyer’s price will have been exhausted at the first auction and all remaining auction attendees will have budget limitations beeneath the first winning bidder’s. Or conversely, the vendor could risk “burning” their auction; a real term used to label a failed auction. Art houses use the term mores than we do in the real estate world, but aside from the associated stigma with the label “burnt”, there is statistical proof that a burnt auction item has a lower chance of selling at auction again.

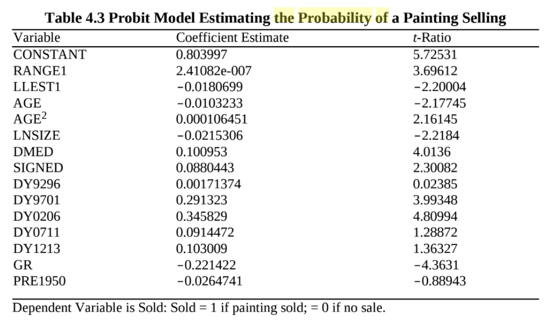

2003 Source: The Economics of American Art

The last auction of the series, however is the interesting one. I’ve witnessed auctions for lower priced items such as kitchen sinks and wholesale appliances, or emotional, intangible items such as art, predictable value items such as cars, and estate jewellery auctions.

The interesting observations are usually at towards the end of the auction series.

Buyers who have been waiting it out, hopeful for a lower auction result on the basis that the buyer pool will erode as items are purchased throughout the day, (or year), may have a successful strategy, or they may find that their strategy backfires.

It all depends on the total number of auction participants in the first place.

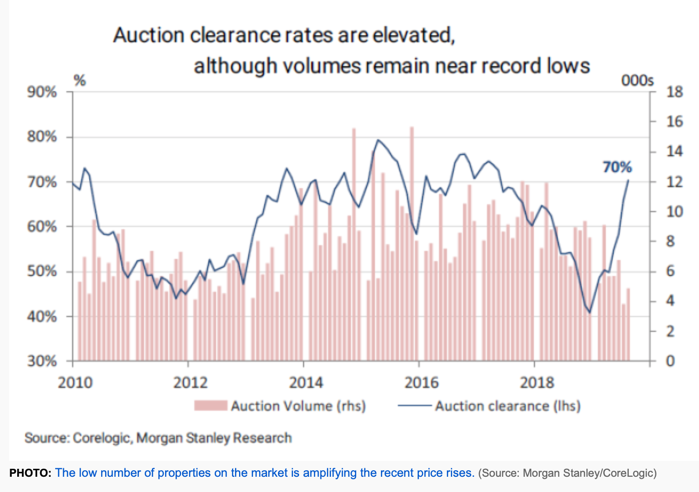

In a Buyer’s Market where supply outstrips demand, this strategy can work beautifully. The final items in the auction house could either sell for a steal or even fail to reach reserve. We saw this in our Melbourne property market late last year when negative sentiment gripped and December auction clearance rates plummeted.

However, in a Seller’s market, the scarcity value of the item increases as it becomes obvious that supply is dwindling and demand is incrementally increasing.

This occurred yesterday in West Footscray, (and presumably in many other parts of Melbourne and Sydney), as our remaining stock is depleting in this final week of ‘trading’ before Christmas shut down.

Buyer numbers have heightened since May when interest rate cuts, lender credit policy relaxation and our Federal election result spelled the end of the negative gearing abolition, (for the foreseeable future at least). Stock has remained low in relative comparison to past years’ though, and our Bull market run indicates the sheer power of sentiment and undersupply.

Last weekend on Saturday 7th December, this charming, renovated 3BR house on 381sqm of land went under the hammer and surpassed expectations when over six bidders fought for the keys. The reserve in the mid nines was rapidly eclipsed and the property sold for $1.025M.

Seven days later, this gorgeous 3BR house on similar land, but un-renovated went to auction. We anticipated underbidders from last weekend’s auction could have been in attendance, but what we didn’t anticipate was an auction result that exceeded the prior property’s. Arguably an inferior product, the power of limited supply impacted this sale result.

True to the auctioneer’s spiel, buyers indeed took heed of his words of advice. …“Ladies and Gentlemen, this is the last auction weekend of the year. There won’t be another like this, and if you miss this one, you’ll be waiting until February or March.”

Appraised by us at mid nines initially, we did feel the need to prepare our clients for a strong result after the prior weekend’s surprise result.

The hammer fell to an advocate for $1.033M who had secured it for an investor client after fighting it out for some forty thousand dollars with another determined homebuyer.

Whether a winning bidder of the last auction of the year/night feels a sense of relief in the face of an unknown, but potentially more powerful 2020 market, or experiences “Winner’s Curse”, (a recognised phenomenon that often strikes a bidder who questions their own appraisal of value post-auction), one thing we know about auction markets is that they are governed and influenced by many different factors, including auction order and available time remaining.

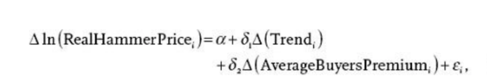

Art of auction analysis is one thing, but much can be gleaned from science too.

Source: The Economics of American Art

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU