Underquoting… the topic pops up every time a market turns up. However, it generally exists in Melbourne for auction campaigns and underquoting frustrates buyers often.

This year, calls to Consumer Affairs Victoria have increased on past years. This is unsurprising, because our city’s capital growth is now in positive territory, as opposed to last year’s market conditions. With renewed market confidence and stronger buyer participation, underquoting attempts are far easier to pass off as “strong buyer competition”, and some agents will employ it.

Buyers who chase mirages miss the chance to purchase a property within their reach, and in a positively trending market, the sense of loss can be enormous when they realise their mistake.

However, there are four simple methodologies that buyers can apply when it comes to assessing properties that may smell of underquoting. The fifth method is more challenging, however and can take many hours. Let’s consider the simple methods first…

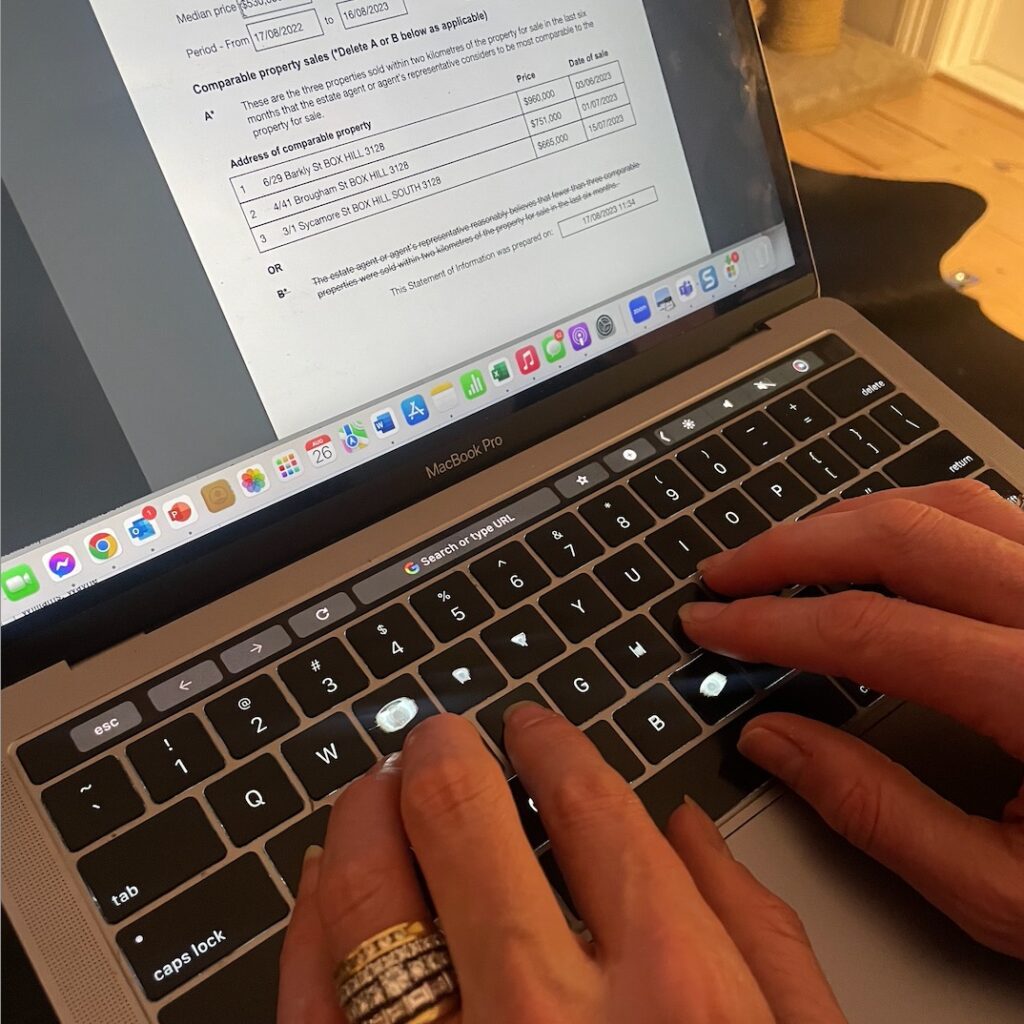

The first relates to the Statement of Information. On every listing in Victoria, our legislation requires that all listing agents populate a ‘statement of information’ citing three recent, comparable sales to support their price quote. In metro Melbourne, the three recent sales must not exceed a six month period. In regional Victoria, these sales cannot exceed an eighteen month period.

Some agents resist citing comparable sales when they feel that there are insufficient sales.

Buyers can conduct an initial check of the “comparable sales” before embarking on more due diligence. All they need to do is search the cited addresses on the internet. Checking land size, dwelling size, condition of the dwelling, age, style, location and orientation is important. If the cited “comparable sales” are in fact inferior, this initial check will prove it’s value for the buyer.

Some quote ranges are based on inferior cherry-picked sales.

Whether it be properties of inferior style, smaller land size, or compromised locations (such as main roads, train lines or inferior pockets), some statements of information are entirely unreliable.

The second method I apply is to check the sales history of the property. While we subscribe to a CoreLogic paid portal, simply utilising google can sometimes shed light on recent sales data. Only yesterday I checked a Hawthorn listing with a quote range of $2.5M – $1.75M, only to find that the same, broadly unchanged property last sold for $2.55M eight and a half years ago. Surely, the capital growth rates spanning almost a decade would spell a significantly higher estimated selling range than the quoted range.

The next method I employ relates to gross rental yield. This can be calculated by annualising the appraised rent, and dividing by the price. For example, a recent townhouse sale sparked my interest and proved this theory.

This Box Hill property was price quoted $900,000 – $990,000, yet the rental appraisal provided to me stated $900 per week, based on a recent tenancy prior to the sale campaign. Gross rental yields for quality townhouses in Melbourne generally don’t eclipse 4%, and many sit closer to 3%.

This quote range suggested a 5% gross rental yield, which I knew was entirely unrealistic.

Basic maths told me that a circa 4% gross rental return would spell a sales figure of circa $1.2M. And indeed, I was correct.

The fourth method is easy, but relies on great relationships. I simply ask a friendly local agent to give me their take on an appraised value. A great agent will be familiar with new listings in their area, and they’ll often be happy to share their thoughts on value. Sometimes, they’ll have been privy to the owners’ price expectation because they will have had the opportunity to pitch to the owners for their sale.

The last method is by far the most time-intensive, but it’s also the most reliable. I conduct a full pricing analysis on the subject property. My methods include recent comparable sales analysis, to the summation method. No stone is left unturned and I calculate the land value per square meter and the ‘improvements’ by way of depreciated dwelling value.

This can take many hours, and it isn’t ideal to apply these appraisal techniques every time I spot an underquoted listing.

Applying the first four methods is incredibly helpful for shortcus though. Anyone can use these methods to get a clear picture of whether a property is a potentially viable option, or a mirage.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU