I get asked this question often when I suggest a suitable area for an investment brief. Too many prospective investors anticipate that an exciting hotspot will yield them a phenomenal amount of growth in a short timeframe, yet property investment should always be a long game.

Just because a suburb exhibited boom conditions doesn’t mean that it has no more performance left.

In fact, gentrification has a lot to answer for. Some of our best suburb performers are those that had a renaissance during the 1980’s, 90’s and 2000’s. If we cast our minds back to the stigma of Fitzroy, Clifton Hill, Brunswick, Kensington, Collingwood and Richmond, for example, it is hard to believe that these former working class areas were undesirable. These days, they are tightly held and revered by many, including cashed up baby boomers, young professionals and medico’s.

As the saying goes; “Money grows where money goes.” And these hot inner-areas are perennially popular.

As much as this will resonate with Melburnians who appreciate the inner-ring markets, I still like to demonstrate the power of a performing suburb with data.

The 2006 – 2011 Census data differential was particularly noteworthy for Melbourne’s sleepy Seddon. Wedged between the west’s Yarraville and Footscray, this pint-sized suburb outperformed just about every Victorian suburb during this time of rapid gentrification.

In my early days as a Buyers Advocate, many buyers asked me to “find them another Seddon.” I would respond with “I have. It’s Footscray. But you don’t want it.” That’s the thing about gentrification; it sneaks up on you, but is most powerful while a suburb is still rustic or stigmatised.

Recognising gentrification is possible, but it’s not easy. Retrospectively observing it is far easier.

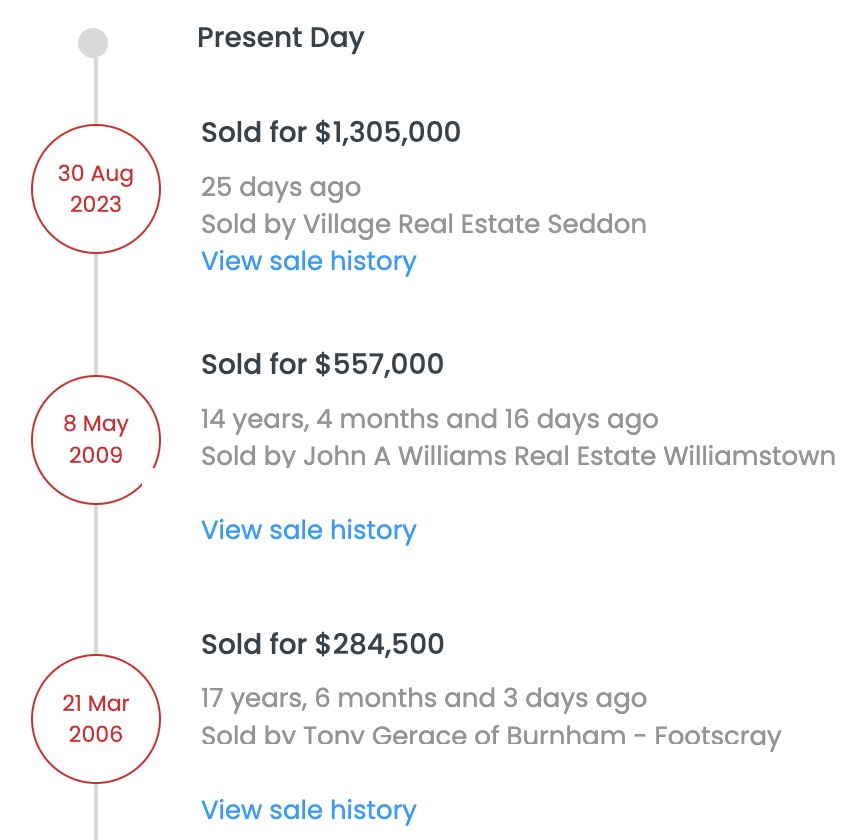

Take this double-fronted Victorian in Seddon which recently sold for $1,305,000. It’s modest renovation dates back more than twenty years. It offers 3BR plus an additional space beyond the laundry and caters to off-street parking. Seddon’s finest street? No, not really. But it is a good house, and a good data point, particularly given no significant capital improvements have been made over the data set collection.

This is a typical Seddon house with data points that illustrate the high performance period that shook up Seddon, yet it also shows what this inner-ring suburb has done over the long term since it’s gentrification.

The sales history shows a 2006, 2009 and recent sale as follows.

When we chart the performance, despite the more aggressive line between 2006 and 2009, nobody could argue that the performance since 2009 has still been stellar.

This period of extreme growth in red aligns with the Census data, which signalled Seddon outperformed significantly during the 2006-2011 data collection period.

This property grew by a whopping 24%, year on year during this heady time.

The owner who purchased the property back in 2009 and sold last month experienced just over 6%, year on year. Whilst this is much lower, this period also sat through some significant challenges and downturns.

Had the initial owner held the property long term, the capital growth delivered would have sat at just over 9% year on year, no mean feat for any Melbourne suburb.

Quality suburbs with high amenity can certainly gentrify. But they don’t just exhibit a flash in the pan and then stop performing.

Investors who can identify sustainable growth drivers are the ones who will be best placed to enjoy strong equity gains over the years.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU