Lender’s Mortgage Insurance is not well understood by many, but there are plenty of quirks and benefits to be aware of when it comes to buying property.

Lenders Mortgage Insurance, (LMI) is quite a costly insurance. It benefits the lender, not the borrower, and in most cases, the lender passes this cost on fully to the consumer. LMI premiums typically range into the tens of thousands of dollars, and sometimes they can cost hundreds of thousands of dollars.

Lender’s Mortgage Insurance is an insurance policy that protects the lender from not being able to recover the full amount of the mortgage debt in the event that a borrower defaults. In other words, if a borrower is unable to make their mortgage repayments, at some stage a lender will sell the property to recover the debt. In the event that the sales price is less than the amount loaned to the borrower, the lender will need this insurance cover in order to avert losses.

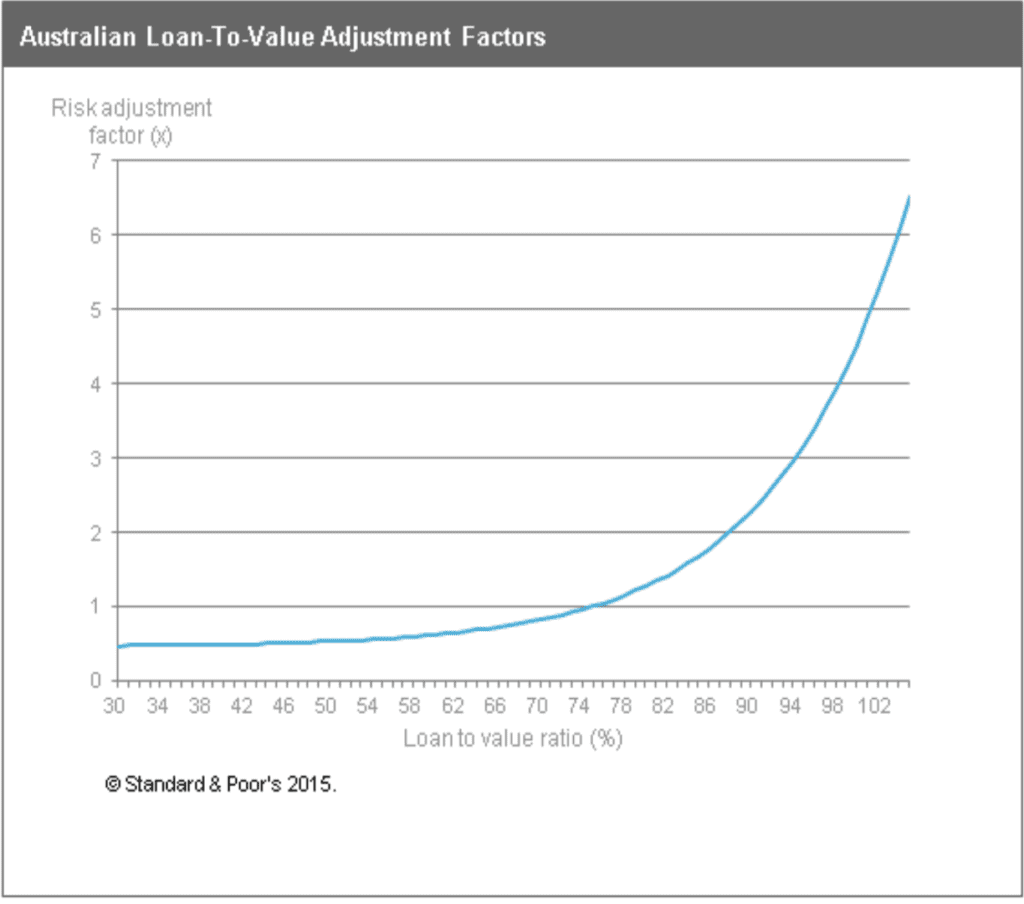

Loan to value ratios, (LVR’s) of 80% or lower are typically considered safer loans for the lender, and as such a consumer won’t generally be required to purchase the LMI premium. It is considered that the risk increases exponentially as the LVR approaches maximum thresholds. This risk factor is shown on this chart below from Standards and Poor’s.

“By way of illustration of the intrinsic risk of high LVR loans, Figure 1 (sourced from ratings agency Standard & Poor’s (S&P)) maps the relative risk of Australian mortgages with different LVRs. From this, we can see that S&P considers that the relative risk for Australian mortgages rises exponentially for loans with an LVR above 80%. For example, a 95% LVR mortgage is considered to be approximately three times riskier than a 75% LVR mortgage.”

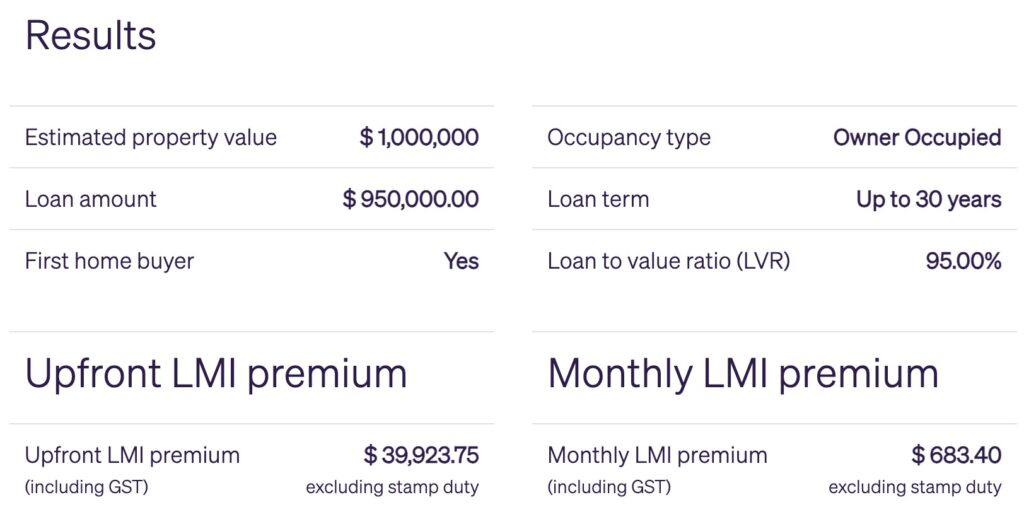

For context, this LMI Calculator from Helia (formerly Genworth) shows that a first home buyer purchase of one million dollars with a $50,000 deposit would attract a once-off premium of almost $40,0000.

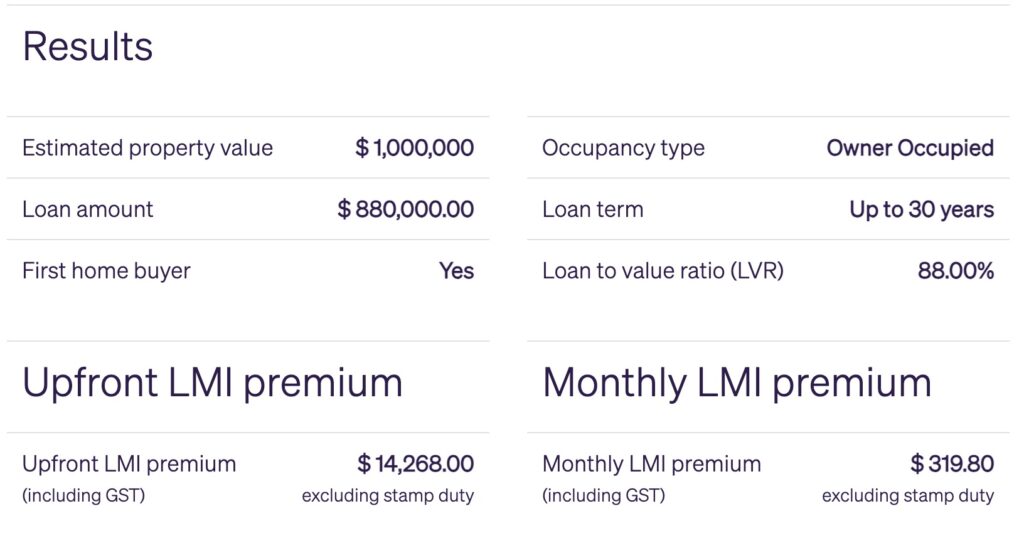

However, the same purchase with a 12% deposit (88% LVR) would attract a premium of almost one third.

LMI is often debated, though, and as Peter Koulizos has famously stated, “it’s the cost of doing business.”

It is important to note that LMI insurer’s often have the last word when it comes to the security property (or in other words, the property that the loan is required for). Postcode restrictions, price tag limits and scrutiny over vacant land can make or break a purchase. It’s essential that a buyer understands the risks and limitations of an insurer’s appetite when considering the location, type and cost of a property.

Checking with a strategic mortgage broker is strongly recommended if borrowings are above 80%.

There are some reprieves though. For some (lucky) medical and legal professionals, quite a few lenders will waive their LMI altogether. There are terms and conditions including annual income requirements and ability to prove their profession.

And for many other professionals who qualify, an increased LVR up to 90% is on offer for them without the need to purchase LMI.

Mortgage Providers have collated a list here.

And lastly, for those who don’t fit this criteria and are searching for some LMI relief from the lender, some of the Westpac subsidiaries such as Bank of Melbourne, Bank SA and St George sometimes offer no LMI loans at 85% to eligible customers.

And for those who have wondered if LMI can ever be refunded, in certain circumstances, some insurers will offer partial refunds.

It’s worth discussing all of these offers with your strategic mortgage brorker.

This isn’t where LMI starts and stops, however. There are several other ways for borrowers to avoid LMI.

Our federal government have introduced the First Home Guarantee, and while places are limited each year, many can take advantage of it with the support of their strategic mortgage broker. There are three categories within the scheme including first home buyers, regional first home buyers, and single parent home buyers. All opportunities enable eligible borrowers to avoid paying any LMI fees. The Australian Government underwrites the risk for specific lenders included here. The first two categories enable a borrower to purchase up to a capped amount in their state/territory with as little as a 5% deposit. The latter is based on a reduced deposit amount of just 2%. While this is a fantastic incentive, sadly it’s only open to 5,000 eligible borrowers per year.

The First Home Guarantee currently offers 35,000 places in this financial year.

“First-home buyers aren’t the only ones who can participate, though. Recent changes to how the First Home Guarantee’s eligibility criteria work has meant that borrowers who haven’t owned a home in ten years can also get their high LVR loan guaranteed too.” (Source First Home Guarantee)

The challenge with this initiative is often around the price caps. In Melbourne and Geelong, the offer is only available up to $800,000, and in regional areas (other than Geelong), the cap is $650,000. Buyers can check the postcode cap tool here.

Another well-discussed option for buyers who wish to avoid LMI is to have parental support in one of two forms;

A guarantor loan, also known as Family Pledge Loan, or a Family Security Guarantee Loan is an option for those who’s parent(s);

- have equity in their home

- are eligible to access it and provide it to their child(ren)

- wish to take on this risk

It is a serious commitment for both parties and for obvious reasons, involves a discussion with a lawyer or solicitor.

A gifted deposit is the other option, but again this requires signatures and often legal input due to the risks and serious nature of the arrangement.

This blog was prompted by a lovely Sunday blog reader who asked me to write about LMI, the deposit guarantee scheme, and some of the things that buyers may not know.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU