Sentiment counts for so much, and it’s interesting to see the correlation between buyer attitudes and interest rate chatter. As our Reserve Bank meetings approach, plenty of buyers momentarily put their plans on hold and ‘wait it out’ for the RBA interest rate decision. In 2022, real estate agents were cognisant of auction schedules and timing their client’s auctions around RBA meetings. For those vendors who were scheduled for auction immediately following the first Tuesday of the month, apprehension reigned as they worried about the impact of a rate rise on their prospective buyers.

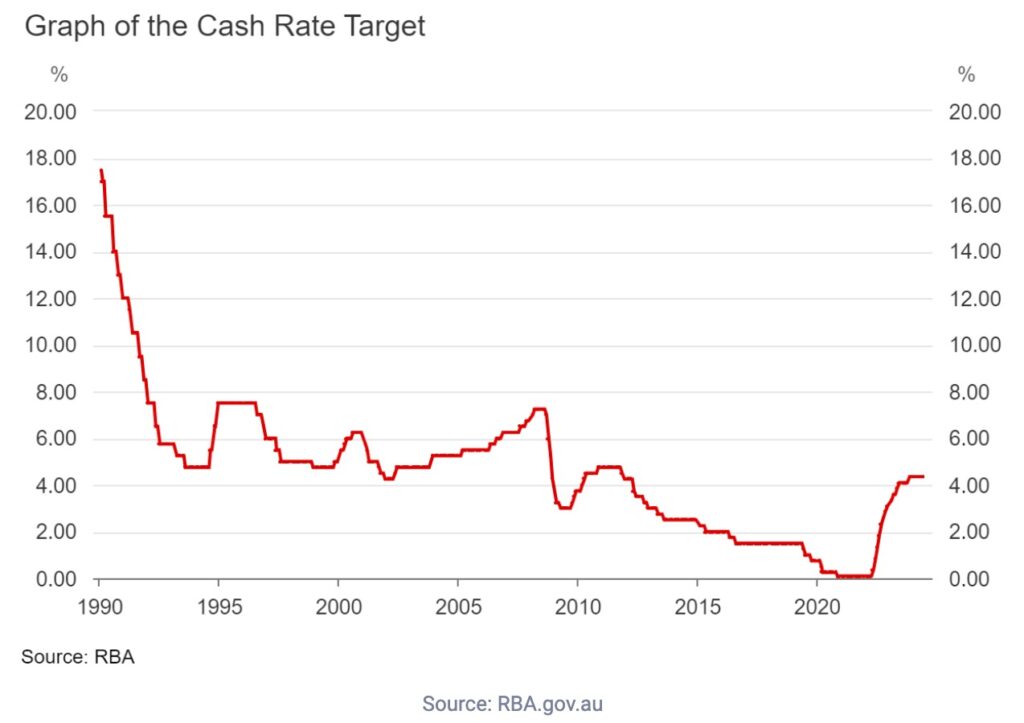

While rates have been on hold now since November 2023, our Reserve Bank Governor’s messaging remains that of concern. Following all board meetings since November, Michele Bullock has reminded us all that inflation is still above the target band, and reducing inflation sit within the 2% – 3% band remains the RBA’s immediate core focus.

Following last Tuesday’s RBA Board meeting, Governor Bullock answered journalist’s questions and she did advise that the Board had considered an interest rate increase, but they hadn’t considered a decrease. Chris Kohler (channel nine) asked a question relating to considerably low sentiment levels, (the lowest since the early nineties), and our RBA Governor made an interesting point.

“But the thing that’s actually really quite positive is employment. While everyone is a little bit down in the dumps, I think it’s also true that they’ve got jobs and I think that’s really important for the future. Now, our forecasts see with tax cuts coming, with inflation declining, that real income is going to start to rise again in the latter part of this year and into next year. And I think that will help people’s confidence; that they will see their real incomes rising. I think that will be important.” (Source: RBA Speeches, rba.gov.au)

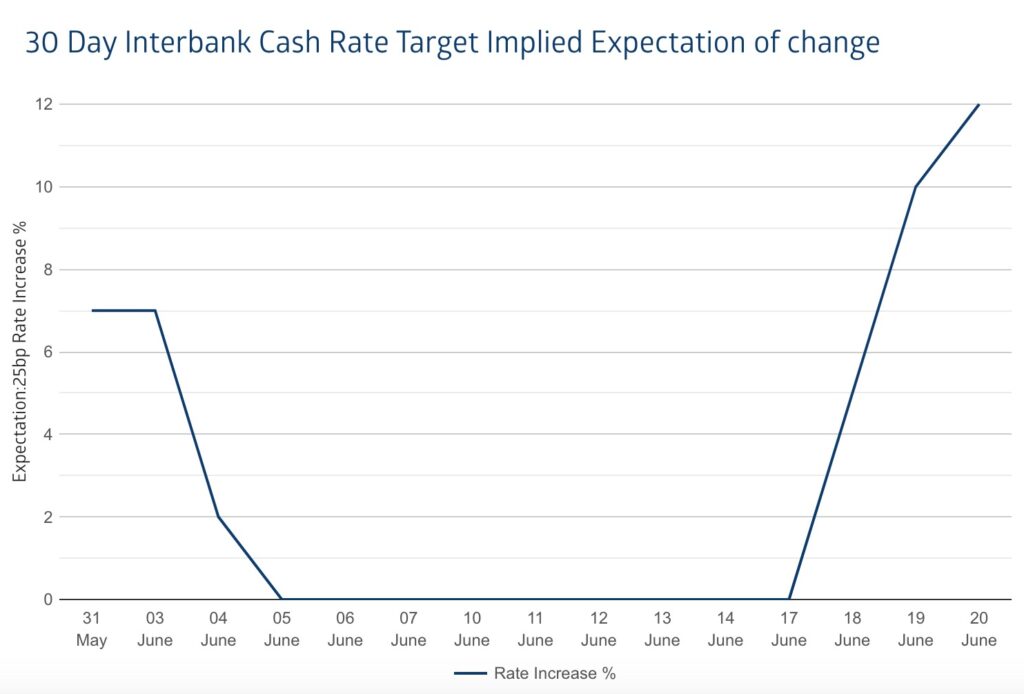

Not surprisingly, the futures figures spoke in the days immediately following the Board meeting.

“The RBA Rate Indicator shows market expectations of a change in the Official Cash Rate (OCR) set by the Reserve Bank of Australia. The indicator calculates a percentage probability of an RBA interest rate change based on the market determined prices in the ASX 30 Day Interbank Cash Rate Futures. The RBA rate indicator provides market participants and commentators with a market monitor for official cash rate expectations in Australia.” (Source: RBA Rate Tracker)

An interest rate future relates to an agreement between the buyer and seller for future performance of the asset (money) based on a future date. Futures (also known as derivatives) can be invested in an alternative asset class.

The 30 Day Interbank Cash Rate relates to the interest charged on short-term loans made between financial institutions and it is the lowest rate that can be found at any particular time.

“On the 18th of June the RBA left the official cash rate unchanged. The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 4.35%. The next RBA Board meeting and Official Cash Rate announcement will be on the 6th August 2024. As at the 20th of June, the ASX 30 Day Interbank Cash Rate Futures August 2024 contract was trading at 95.645, indicating a 12% expectation of an interest rate increase to 4.60% at the next RBA Board meeting.” (Source: Rate Tracker).

Back to the speech and the questions, the RBA will have two potential new elements to track between now and the next RBA meeting. The first is the impact of the tax cuts, specifically in relation to consumer spending versus saving. And a new round of forecasting will roll out in August, sourcing information from the National Accounts, budgets, the labour market and new inflation data.

What is clear is that there is no sign of rate cuts at this stage while the inflation figure sits where it is.

“We’re still hoping, forecasting to have inflation back down into the band by the end of ‘25 and then ‘26 we’ll hopefully be tracking to the midpoint of the band. That’s still what we’re forecasting. But again, we’ve got a new round of forecasting in August.” (Source: Michele Bullock statement 18 June)

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU