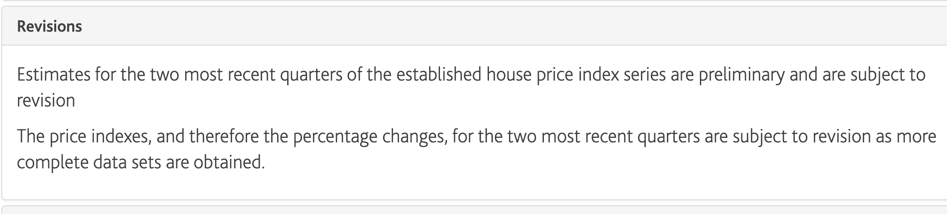

This time, it’s not just Melbourne and Sydney that are experiencing heady growth. In fact, many more regions than capital cities have been outperforming typical market growth rates, and even in the face of COVID-19 lockdown headwinds, our markets have surprised many of our economists.

House price growth in a large portion of our national markets has been strong, and despite the banking economists’ doomsayer predictions of 30% price falls, (only around six to nine months ago), the resilience of our real estate market’s has proven them wrong. Again.

So how did they get it so horribly wrong?

Firstly, it’s fair to say that Australia’s ability to navigate COVID-19 the way that we have, particularly when we contrast how Europe, the UK and the US are faring wasn’t something that we took for granted. We were all fearful, economists included.

Secondly, shelter is a basic need. This is often forgotten, but too many analysis think of housing as only an asset class, but unlike a parcel of shares or bonds, the majority of our property owners in our nation won’t just sell when their asset value is at risk. It’s their home, and most owners are reluctant to sell the family home. When times are tough and divestment decisions are required, most people will sell everything else before they’ll let go of their family home. To support those in crisis, repayment holidays offered by our our banks did make a critical difference in 2020.

The price fall projections were misconstrued and exaggerated by the media. The reports in question shed light on differing scenarios. The 30% price fall scenario was the worst-case. Did the media make this clear? No. The reports were scary, but bad news seems more saleable. Many people read this news and panicked. A large portion of buyers who were in the market chose to sit it out and wait for the crash. We still have some buyers in our market who are forecasting a Job-Keeper-finale-crash in March.

Only time will tell if this was a sensible approach.

The largest three forces, however that were obviously underestimated by our economist gurus were that of interest rate cuts, government stimulus and positive consumer sentiment.

The latter is hard to pick.

Depending the newsfeed and the perceived opportunity/threat, sentiment can turn in a matter of days.

But interest rates and the power of cheap money? It is surprising that this wasn’t front and centre when our market predictions were flying around, and equally surprising when our Victorian Government policy-makers decided that it was a good idea to offer additional stamp duty savings for everyone purchasing a residential property up to $1M before June 30 2021. Our markets were already showing clear signs of recovery when this incentive was introduced, and in combination with talk of “Responsible Lending Guidelines” easing in March, it was clear at the coalface that we didn’t need further market stimulus in this sector.

Now we find ourselves in a challenging market, with soaring house prices, heightened buyer competition, shorter days on market and a mandate to hold interest rates low while we tackle unemployment and GDP.

Housing price growth could become a difficult situation for our RBA and Prudential Regulators to manage. But for now, Governor Lowe’s focus on the real estate market is overshadowed by the bigger picture; our nation’s economic recovery.

Unless we adopt a macro-prudential approach like the Kiwi’s have, (LVR restrictions to slow down Auckland’s house price growth), our house price growth may well eclipse the latest economist predictions of +16% over the next two years.

I’m comfortable to go on the record and state that I believe our housing markets will deliver this level of growth in one year.

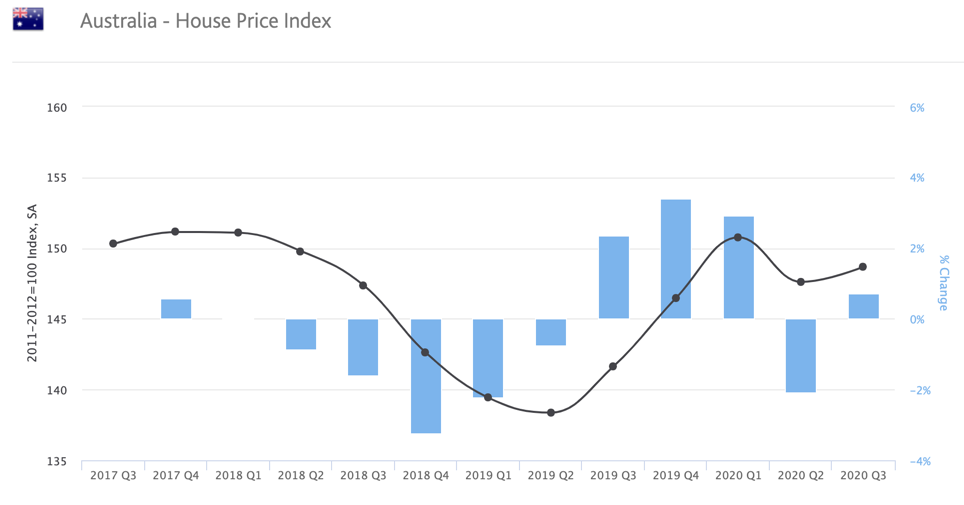

This is a bold statement, indeed. But the insight from the coal face always precedes the data that follows. It boils down to one deficiency; data lag. From a technical perspective, our house price index data is compiled by the Australian Bureau of Statistics. We see reports released by CoreLogic (and others), but the collation of the data itself is managed by our government’s independent statutory agency.

The data integrity may be high, but it isn’t always timely. A data set is only finalised when a property has settled and the sale is recorded by the corresponding State Revenue Office. Moody’s state clearly below that “house price index series are preliminary and are subject to revision”. The second paragraph below refers to unsettled sales.

As we in the industry know all too well, a heated market will often have a direct effect on a buyer’s desired settlement period. When markets are trending upwards, many people will opt to buy-first, sell-second in an effort to protect their own currency. In other words, they will be reluctant to sell for today’s price, and buy later in an upwards moving market.

Right now, settlement periods are longer.

This impacts our data-lag issue even more so. The price growth that the data is reflecting in the charts is not commensurate with what we are experiencing at the coal faace.

We can anticipate strong growth in our February data on March 1, but even then it won’t be representative of the growth that is actually occurring at present.

Buyers at the coal face are likely to be well-aware of the conditions in the market. Queues at open homes are long, bidder numbers at house auctions are often eclipsing ten people in the inner and middle rings of our cities, (including our large regions), and days on market for private sale campaigns are ridiculously short, with numerous reports of multiple offers received at initial open for inspections.

We are working with a number of buyers who have experienced heartache with auction and negotiation losses. It’s brutal.

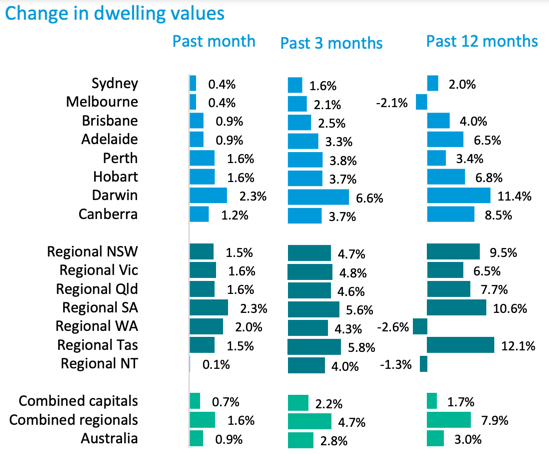

Traditionally we’ve always been able to pinpoint a reasonable estimate of the likely selling price with our comparable sales analysis. However, the pace of this aggressive market is rending some of our recent sales redundant. Take for example this property that went to auction yesterday in Coburg. We appraised 8 Stawell St at circa $1.2M based on comparable sales; one sale as recent as 16 days old in the same street, featuring same orientation and land size. It could be argued that this nearby recent sale was superior given the size of the dwelling, but spirited bidding saw the smaller dwelling’s price tag eclipse the larger neighbour’s.

The resultant price was more than 5% above our technical assessment.

The rest of the day’s auction activity broadly mirrored this trend. From 5% to 9% above appraised value, we didn’t have such a successful auction day. Only one of our four auctions were secured yesterday.

Does this mean that buyers need to be prepared to factor in 5% price surges in this market? Five per cent is a significant stretch, and buyers should always gauge the popularity and uniqueness of a property before they decide to adopt a stretch budget like this. They need to ask themselves;

- is it rare?

- are listings like this infrequent?

- how easily will I find another that is similar?

- do I have time pressure?

If the market offers many more dwellings like the subject property, a buyer should weigh up the risk of overpaying with the risk of waiting it out in a moving market.

Historically we have supported a 5% stretch for a home buyer who has found a special property, and a 3% stretch for an investor who has identified a high-scoring property.

However, this market is challenging the best of us. A ten per cent stretch, despite tough market conditions, is not what we’d advocate.

Identifying recent comparable sales is paramount. Any sales dated pre-Christmas are not all that helpful in this market. Being aware of the market conditions is imperative, but bear in mind that the wind can change, and when it does, it changes quickly.

Property should be a long game, so applying a stretch budget in a hot market to secure a great property is sensible, but don’t stretch so far that a slight change in wind direction leaves you exposed and upset.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU