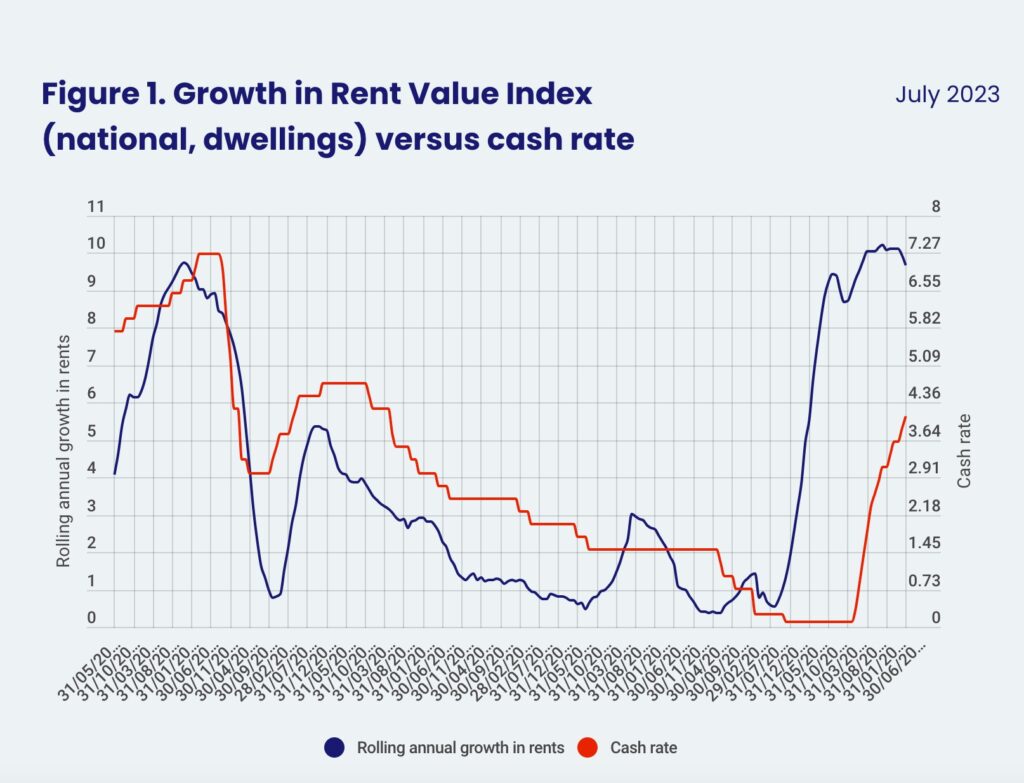

We often hear suggestions that rents have increased as a direct result of interest rate increases. It isn’t that simple though, and anyone who owns an investment property will know that they can’t just pass on rising costs to the tenant when they feel like it.

However, this CoreLogic chart shows a correlation between the cash rate and the rate of rental movements.

The question beckons. Is there a direct relationship?

Is it a question of cause and effect? And if so, which causes which? Do rising rents contribute to, (-and signal) high inflation? Or does high inflation initiate rental increases?

It is fair to say that both cause and effect scenarios are true, but in the case of rising rents, so much more than the cash rate is at play.

Firstly, let’s start with supply, as we all know that insufficient supply to meet demand will lead to price increases. Our current rental stock supply has been eroded by six key things;

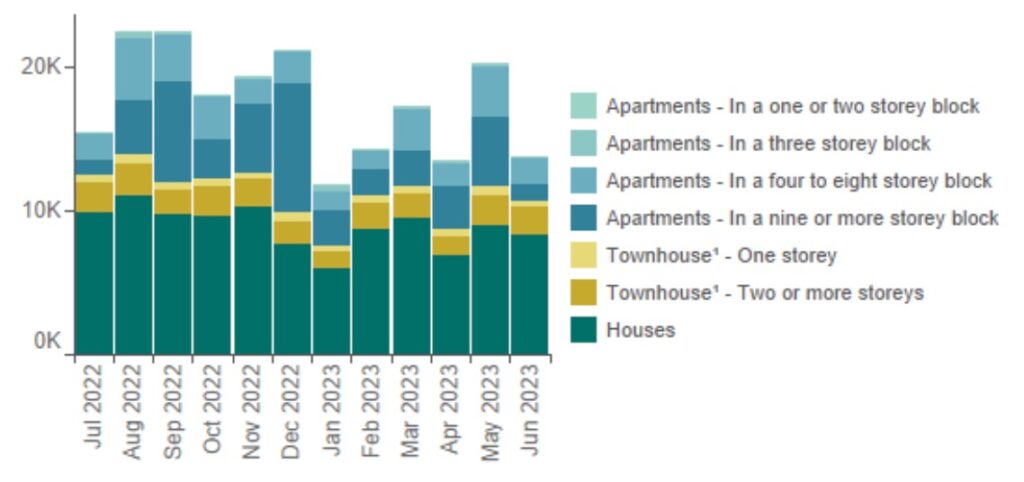

Slow building starts – new dwellings remain a key concern as builder shortages and high materials costs continue to plague the sector.

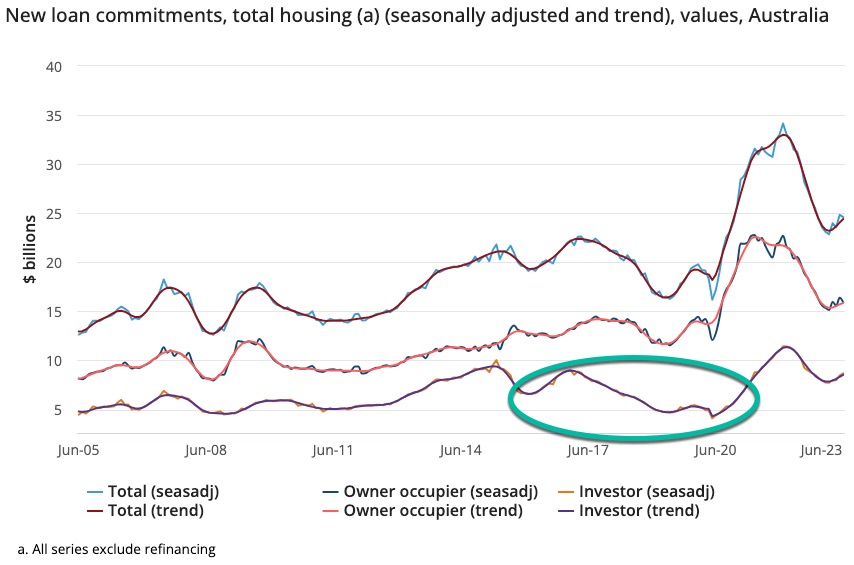

Investor credit limitations – during the period 2015 – 2019, APRA’s intervention hampered the availability of credit to most investors. This in turn single-handedly caused a dramatic reduction of investor activity during this period and our overall count of investment properties fell.

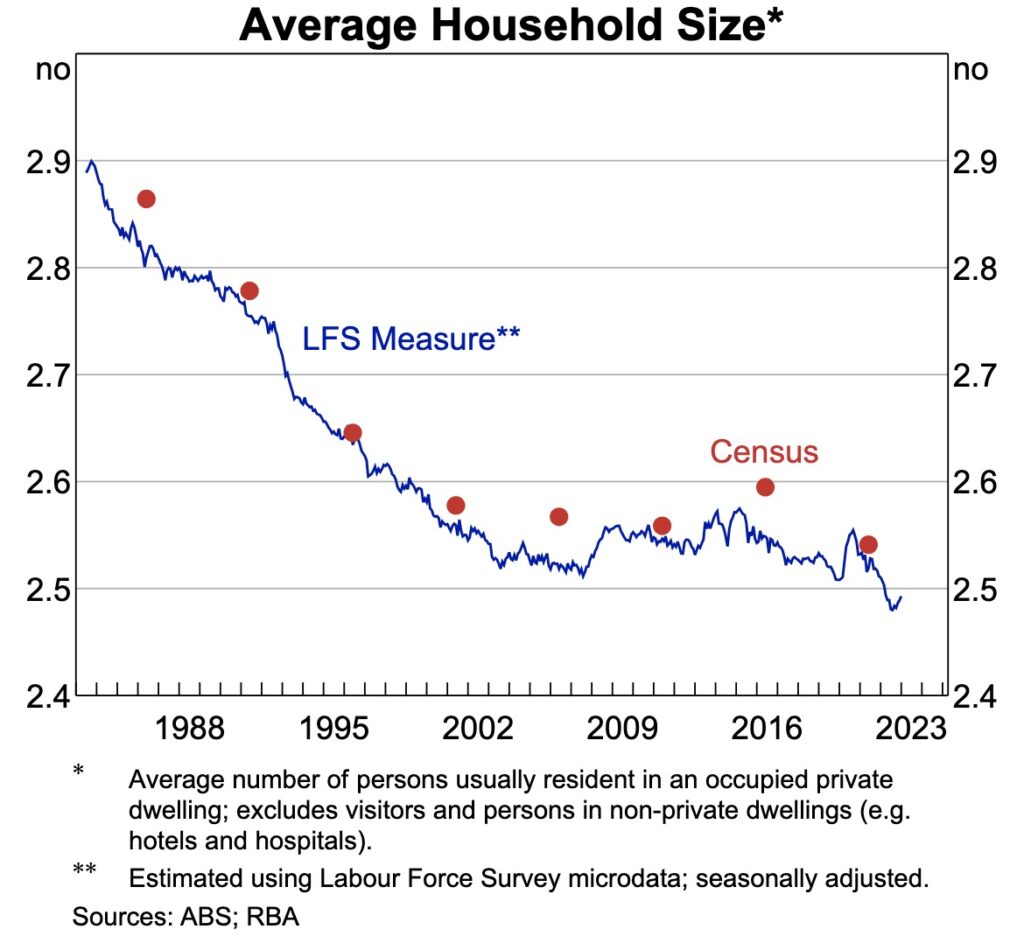

Household formation rates have decreased. This is attributed to higher divorce rates following COVID lockdowns, less share house inhabitants, increased first home buyer activity and solo purchasers. As households have less people living under one roof, more households result, hence taking up additional housing.

Growing population – similar to the point above, as more new arrivals live in our cities, more housing is required. Many of these migrants rent when they first arrive, despite our skilled migration policy requiring skilled job candidates.

Onerous rental reforms – there is no doubt that many investors have opted for other asset classes as our state government controls have clamped down on investors and favoured the rights of tenants.

Heightened borrowing costs – more recently, investors have been selling as a result of tougher holding costs as interest rates have increased.

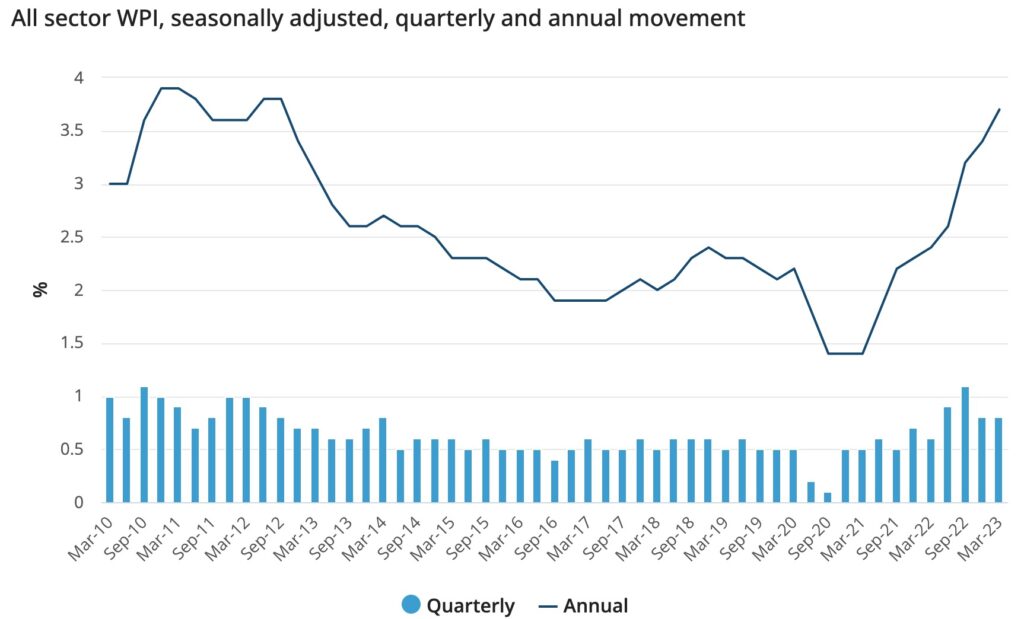

Now that we’ve considered supply, we then need to consider demand. Overlay this supply issue with the increased financial capacity of renters. This wage price index clearly shows that incomes are finally catching up with the increased cost of living.

The relationship between cash rate and increasing rents will be an interesting one to watch over the coming years. We can’t finance and physically build enough rental properties to meet the demands of our renters, even with cash rate decreases forecast into 2024 and 2025. Considering that 83% of our rental housing is supplied by private investors, (aka “Mum and Dad investors”), I believe our rental supply issue will continue to bite until net investor participation once again grows.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU