Our newsfeed headlines have done a bit of an about-face in recent weeks. Bank economists have all stepped down their predicted price falls for our markets, both capital cities and regions, and even for those who held dire concerns about the Melbourne market, updates from the coalface seem to be flying in the face of earlier bearish commentary.

We find ourselves in uncharted waters, yet the hallmark of 2020 seems to be just that. In fact, if things reverted back to the old ‘normal’, we’d probably all feel a little unaccustomed to the predictability and regular time horizons of traditional Spring market campaigns.

Adapting quickly, facilitating buyer inspections under time pressure, running a water-tight diary schedule and managing contract tasks remotely are our new norm now.

Buyers are out in force, borrowing capacities are higher for many than pre-lockdown, government incentives are on the table and there aren’t enough properties on the market to meet the demand.

It’s a seller’s market, but plenty of other headwinds are proving a challenge for buyers.

Firstly, properties are selling fast. Buyers who manage to get one inspection in are often faced with the prospect of a tight timeframe to make an offer. Plenty of agents are receiving strong offers, a reflection of pent-up demand over the lockdown period, and motivated vendors are generally demonstrating that they are happy to cut their auction campaign short and accept a reasonable offer.

For the subsequent inspection appointments following an offer, agents are advising prospective purchasers of the acceptable offer(s) and buyers have a finite period to quickly scramble together an offer, or miss out.

Our advice to buyers is to consider getting themselves “offer-ready” if they have high hopes about a particular property they’ve earmarked to inspect. This includes; obtaining a contract of sale to review prior, taking video footage of their inspection, (in preparation for the need to make a purchase decision quickly), and assessing some comparable recent sales in an effort to understand realistic pricing.

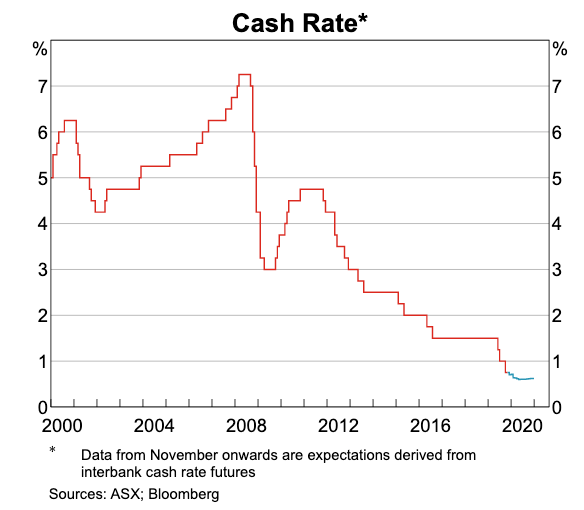

Secondly, investors are back. Since our credit tightening pre-2019, investors have rapidly comeback to the fore. The combination of low interest rates and tight vacancy rates have enticed investors to consider property as an asset class, particularly considering the sharemarket volatility and risk this represents.

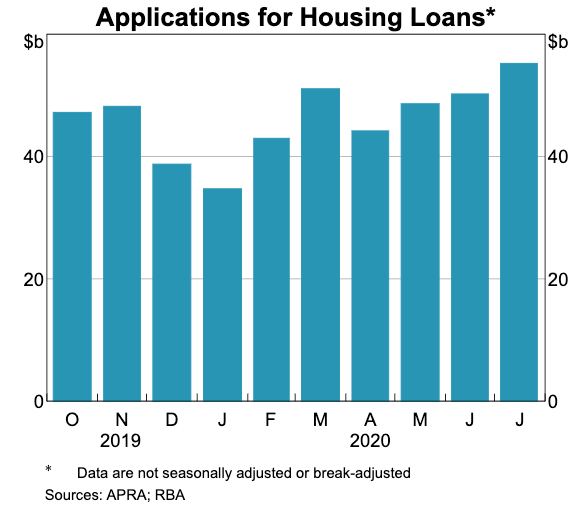

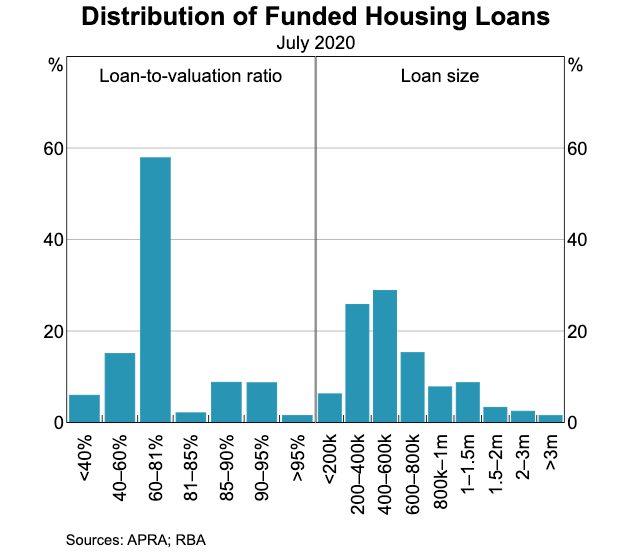

Thirdly, more owner-occupiers are getting finance to purchase, and the amount that they are borrowing is higher. These two charts below illustrate this point.

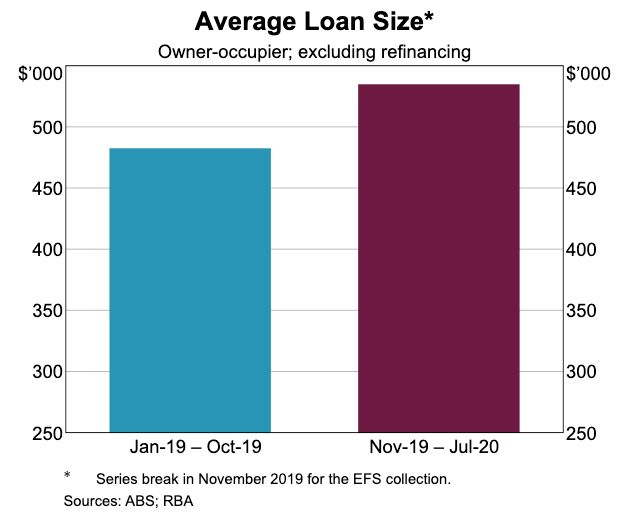

The third chart is the interesting one.

This shows an intriguing observation. The vast majority of new loans are lower LVR’s (loan to value ratio gearing). This highlights those who are more likely to be asset-backed, or in other words, upgraders, down-sizers, or first home buyers who are reaping the benefits of either gifted money or parental guarantor arrangements.

Typically, first home buyers enter the market with a deposit below the favoured 20% mark.

In addition the average loan size lands at the half a million dollar mark; another headwind for first home buyers to battle with when acclimatising to competing buyer interest from those with a more favourable equity and savings position.

Stretching that little bit above budget is easier for a buyer who has the little bit extra available.

One interesting hallmark of lockdown that we’re all witnessing now is the re-emerging of previously under contract properties. Many buyers took the opportunity to secure a property during the lockdown with a ‘subject to inspecting it’ clause. For many, their dream property isn’t quite what the photos and floorplans had them envisaging, and these buyers are utilising their out-clause and the properties are being relisted onto the market. To compound this issue, a number of these buyers are looking around, asking themelves whether they should have, in fact, waited for something better.

In markets like this, it’s not unusual for FOBABBO to strike.

Fear Of Buying A Better Option

Buyers need to take stock of the current conditions, be prepared for tight timelines and tough pressure, but also remember that stock is still coming onto the market.

Now is not a time to be impetuous. It’s a time for being prepared.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU