We are often asked about deposit bonds, especially when agents or vendors reject a request from a buyer to use one. What are they? Is there a risk? And when are they particularly useful? Today’s blog answers all of these questions.

A deposit bond can be used effectively when a purchaser has the means to buy a property, but doesn’t have immediate access to the funds. For example, the following may be at play:

- A recent sale of a property that is yet to settle

- A recent sale of a property that is awaiting a Section 27 early deposit release

- Funds tied up in a fixed term deposit

- Funds owing from a recent business sale or debtor payment

Deposit bonds aren’t available to just anyone. The purchaser needs to qualify for the deposit bond by demonstrating that they do have the means to settle the purchase. At the time of application, the insurer will require the applicant to provide evidence of their financial position, much like a bank would require for a loan approval.

Deposit bonds come at a price though, and a buyer will have likely exhausted all other options before resorting to a deposit bond. Other options include;

- negotiating a smaller deposit with the agent

- taking out bridging finance

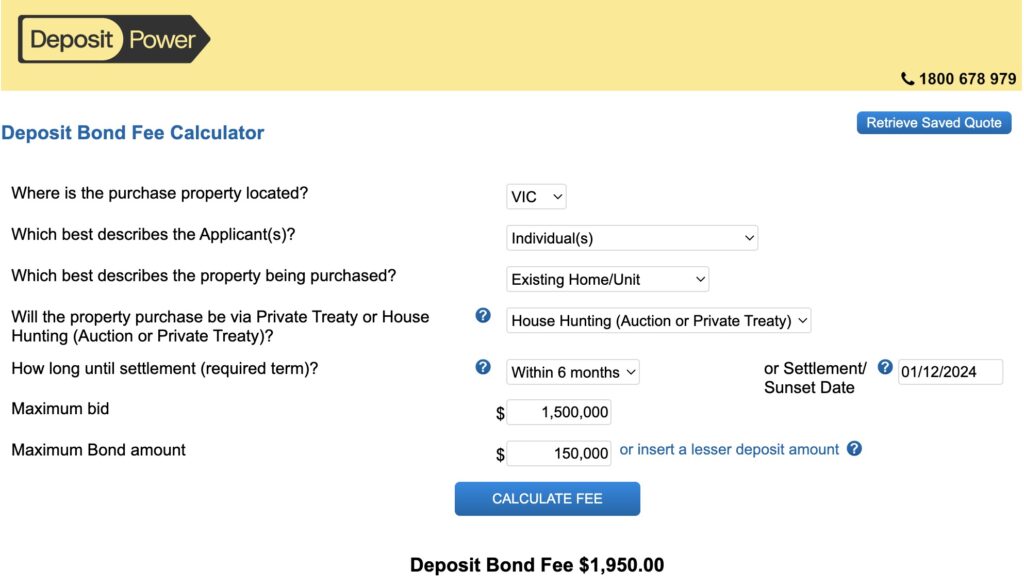

The cost of a deposit bond is based on a few variables, including the magnitude of the deposit, and the timeframe to settlement. Below is an online quotation for a ‘short term’ bond for a $1,500,000 purchase.

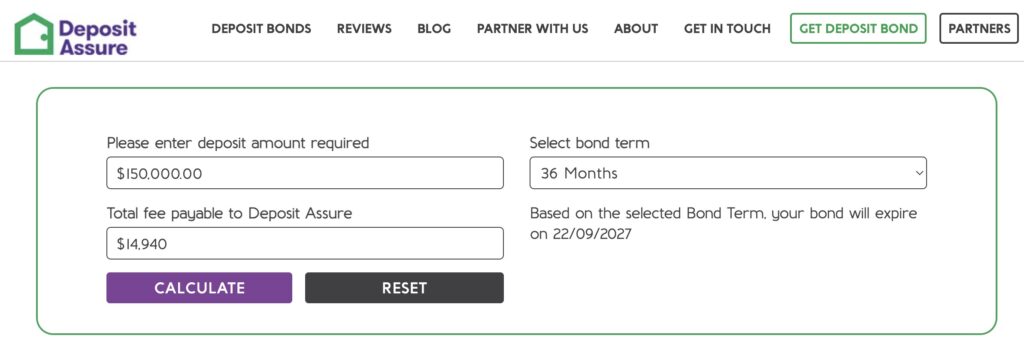

A ‘long term’ deposit bond is typically used for off-the-plan sales and is an effective way for a purchaser to resist their funds being tied up for many months, (or years in plenty of cases). As the below illustrates, the cost of the long term bond is far greater. This is based on the risk of the applicant’s personal circumstances changing over this period.

A deposit bond is not legal tender. It isn’t cash, nor is it electronic funds.

A deposit bond is a guarantee from an insurer that the deposit will be paid to the vendor if the purchaser defaults, (fails to settle). Hypothetically, if the purchaser could not raise the funds to settle their purchase by settlement day, the vendor would serve the purchaser with a rescission notice and the purchaser would have fourteen days (in Victoria) to finalise their full payment before the contract is ended by the vendor. Typically, a vendor would then retain the 10% deposit and re-sell the property and potentially pursue the purchaser for any associated losses. In the case of a deposit bond payment, the vendor would then issue a claim to the deposit bond provider (insurer) to receive their 10% deposit.

Deposit bonds raise an issue for some owners for various reasons. Often they misunderstand what a deposit bond is, and how rigorous the application process is for the buyer.

However, there are two main reasons why a vendor would reject a deposit bond.

- They need the funds via early deposit release to purchase their next property.

- They have doubts about the economic viability of the deposit bond provider. If the insurer goes into liquidation, the vendor’s ability to claim the deposit in the event of the purchaser defaulting may be in doubt.

Agents and solicitors often disregard deposit bonds too. For the reasons above, they will be justifiably protective of their vendor. In addition, an agent’s sales commission won’t be able to be released early if a deposit bond is used.

However, there are reasons why a deposit bond can be advantageous for a vendor and their agent. If the buyer is a qualified bidder and they hold a deposit bond, the vendor can be assured that not only have they paid a fee to be able to bid, but the insurer has deemed that they have the financial means to settle.

This can be more of a guarantee than a bidder who has not arranged a loan preapproval.

The inclusion of a bidder adds to the potential competition, and in turn will possibly deliver a higher result for the vendor.

For the purchaser, a deposit bond can be held for multiple auction/negotiation attempts. It can also be arranged by a strategic mortgage broker.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU