Recognising that our needs will change and lifestyle will evolve is important. Provisioning for this in advance can be clever. But how far out is too far out when it comes to predicting your timeframe?

I meet with prospective clients often who have this strategy in mind and some reasons are completely rational, yet others are questionable. Considering an expanding family, elderly needs, children’s schooling, and job changes are just some of the future contemplations that arise in our conversations, but determining which are likely (as opposed to which require more thought) is important, particularly when a significant purchase decision is the resultant outcome.

I made this mistake myself over a decade ago and while it seemed like a good idea at the time, we essentially compromised our own buying opportunity and capital growth strategy by mis-predicting our family’s future needs. We had a special affinity with Hobart, Tasmania and after several long weekend trips down to the beautiful maritime city, we decided we’d like to live there permanently. We had jobs in Melbourne, a tiny baby in tow, and almost all of our friends and family, networks and contacts were in Melbourne.

I made this mistake myself over a decade ago and while it seemed like a good idea at the time, we essentially compromised our own buying opportunity and capital growth strategy by mis-predicting our family’s future needs. We had a special affinity with Hobart, Tasmania and after several long weekend trips down to the beautiful maritime city, we decided we’d like to live there permanently. We had jobs in Melbourne, a tiny baby in tow, and almost all of our friends and family, networks and contacts were in Melbourne.

Our work opportunities in Hobart were limited at best. We hadn’t thought this through.

We knew that an imminent move was out of the question and determined that a 7-10 year horizon for our Hobart move seemed possible. We interviewed local schools and formulated our own criteria list with gusto and targeted central Hobart with aspirations of easy walks into town, heritage character surrounds and ample bedrooms to welcome friends and family. We came up with this gorgeous four bedroom beauty in postcode 7000 for $560,000.

Life evolved for us though.

I established my career doing what I love in Melbourne and our family and friends are an important part of our life in Melbourne. Moving to Hobart is not feasible for us, nor would I want to leave my home city now. While the red brick house with Hobart city views is beautiful, we are not likely to ever live in it. It has performed in terms of capital growth and increased rental return, but it hasn’t out-performed a well located period house in Melbourne at all. In fact it has grossly under-performed an equivalently-priced property in Melbourne over our eleven years of ownership.

The property is arguably worth circa- $850,000-$900,000 in today’s market. Had we purchased a suitable property in Melbourne with the same metrics back at the same time, our $560,000 spend would have translated into a much stronger current value.

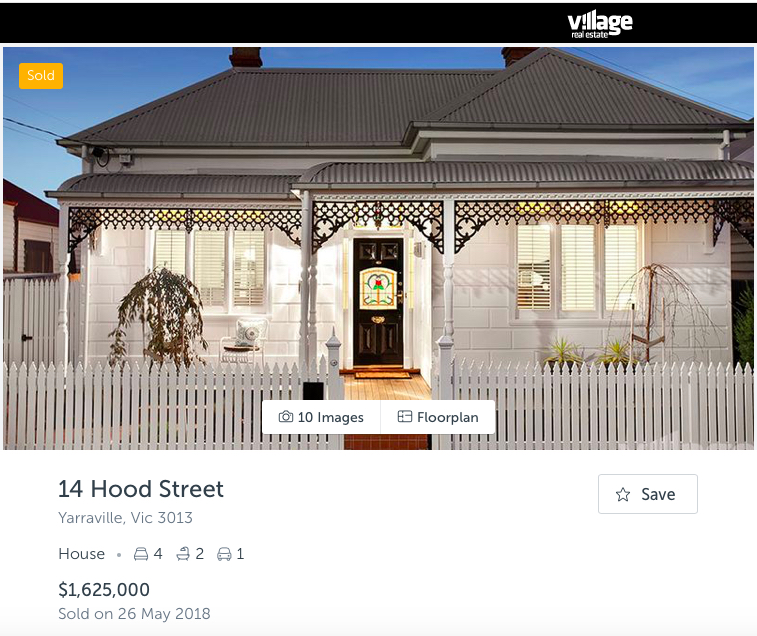

Take this property for example; sold for a very similar price to our $560,000 at the same time of our acquisition. Located within easy walk to Yarraville village, boasting beautiful internal features and offering the same accommodation and living spaces. This house sold in May this year for $1.625M.

Take this property for example; sold for a very similar price to our $560,000 at the same time of our acquisition. Located within easy walk to Yarraville village, boasting beautiful internal features and offering the same accommodation and living spaces. This house sold in May this year for $1.625M.

Our limited insight into our own future needs and the viability of our Tasmania-move cost us in lost opportunity.

But not all future dreams come at a material cost, and not all are a bad idea. In fact some future plans (and the criteria that result) are clever.

Buying a larger family house for a growing family is one of the most common things couples do to future-proof their home.

Focusing on mobility options and ease of maintenance is important for those who wish to grow old in their own home.

And considering commute times in an effort to maximise precious time with loved ones at home when a significant job change is on the horizon has worked well for many a buyer.

Some of the more challenging future-based ideals I’ve witnessed though have resulted in financial loss, lost opportunity and/or significant ‘trading’ costs (ie. stamp duty and agent’s selling fees) when the plans haven’t come to fruition. Some of these include;

- Holiday house purchases when life is too busy for the visits, maintenance and enjoyment of it

- Tree-change/Sea-change without careful consideration

- City-units for student-children before their academic options are clear

- Downsizer ideals long before retirement is due

Future-proofing a home can save buyers significant cost and stress, but getting the future-predictions wrong also comes at a cost.

Planning well, considering the likelihood of the change, factoring in the cost to revert, and assessing the viability of the decision is essential.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU