On Tuesday 25th October, Jim Chalmers made his first budget night treasurer speech for the government of the day. With Albanese sitting by his side, much of the speech was anticipated after several hints and earlier announcements.

Chalmers’ speech can be read here.

Managing the rising cost of living was certainly touched on, as was returning the budget to surplus in time; a seemingly difficult task after the emergency stimulus measures our last incumbent government took in relation to the pandemic. Touted “Budget repair”, an apt descriptor of the task at hand.

Unlike the previous government’s headline items of focus in their March speech, however there was little commentary around defence and COVID-19, and plenty about healthcare, aged care, child care, parental leave, education, renewable energy and housing.

Obviously the latter piqued my interest, (and that of three other industry friends) so we live-streamed the speech and asked each other questions along the way.

Chalmers’ announcements in relation to housing seemed to indicate that the Labour Government are well-aware of the housing crisis that is now biting our nation, yet as Pete Wargent pointed out, the initiatives they plan to roll “will hardly move the needle”.

So what are the initiatives, and why are they not enough?

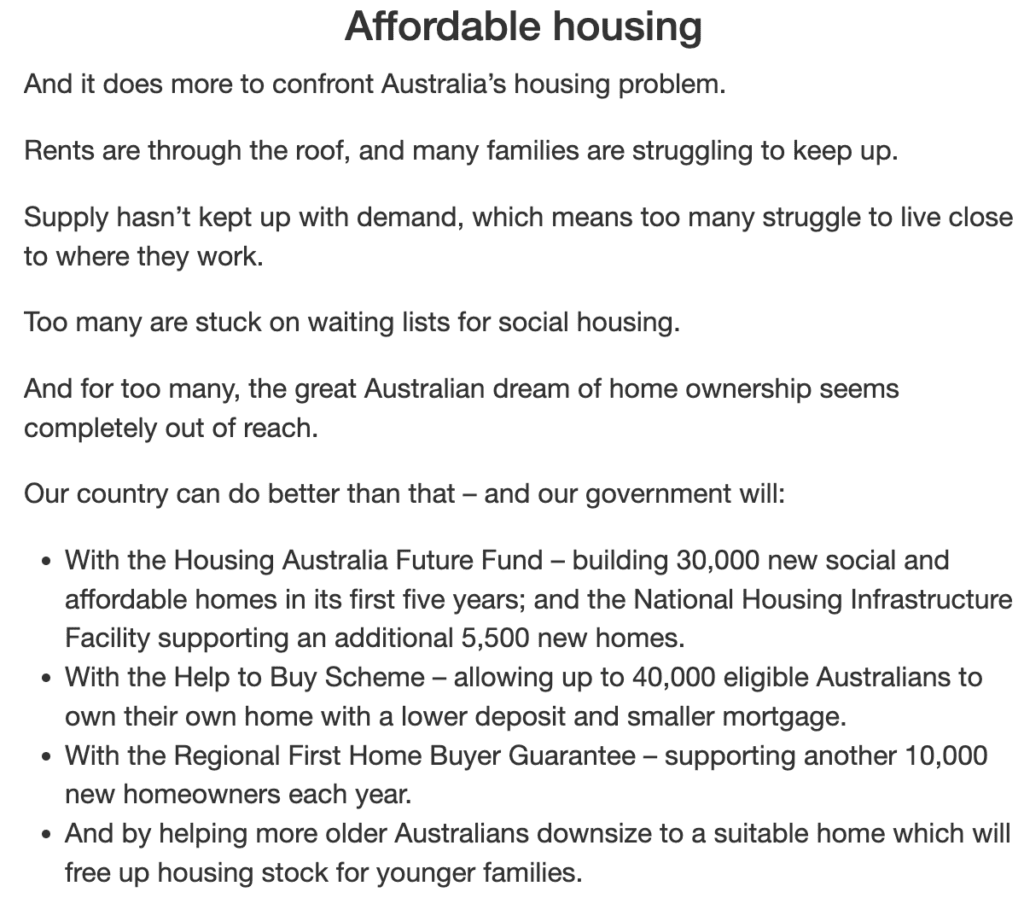

Chalmers’ speech included some initiatives around affordable housing, and in addition the announcement of a new housing accord. First and foremost, the known housing initiatives that were announced by the former government have been retained, (and as some would say, a good sign of bipartisanship), but the immediate concern we each hold relates to that of insufficient help.

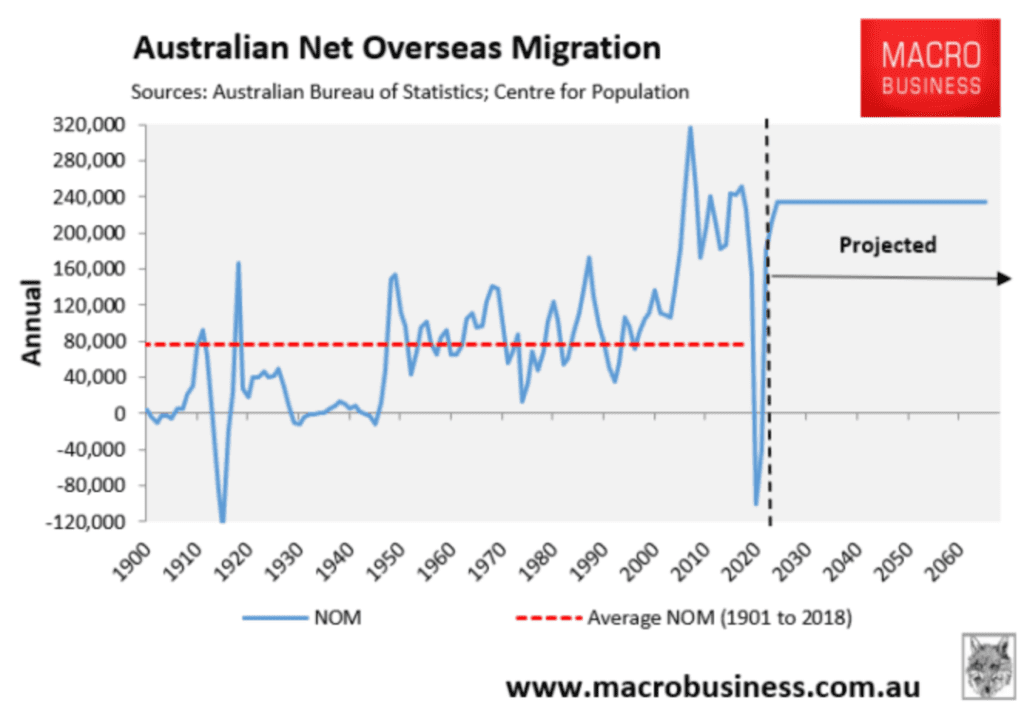

Considering these numbers, and contrasting the tens of thousands of eligible Australians to the hundreds of thousands of new arrivals, (and also taking into account that our current annual “natural increase” in population for March 2021 – March 2022 was just over 130,000), it’s fair to say that these government initiatives listed in Chalmers’ speech for affordable housing will not address the problem of rising rents and homelessness. Nor will they meet the demand our nation is likely to face in coming years.

“Australia’s net overseas migration (NOM) jumped from an average of 90,500 between 1991 and 2004 to an average of 219,000 between 2005 and 2019 – representing an annual average increase in immigration of 140%.

“To add insult to injury, Australia is officially projected to import 235,000 migrants a year over the next 40 years, which will see Australia’s population balloon by an absurd 13.1 million people (50%) over that time period.” (Macrobusiness. Leith van Onselen)

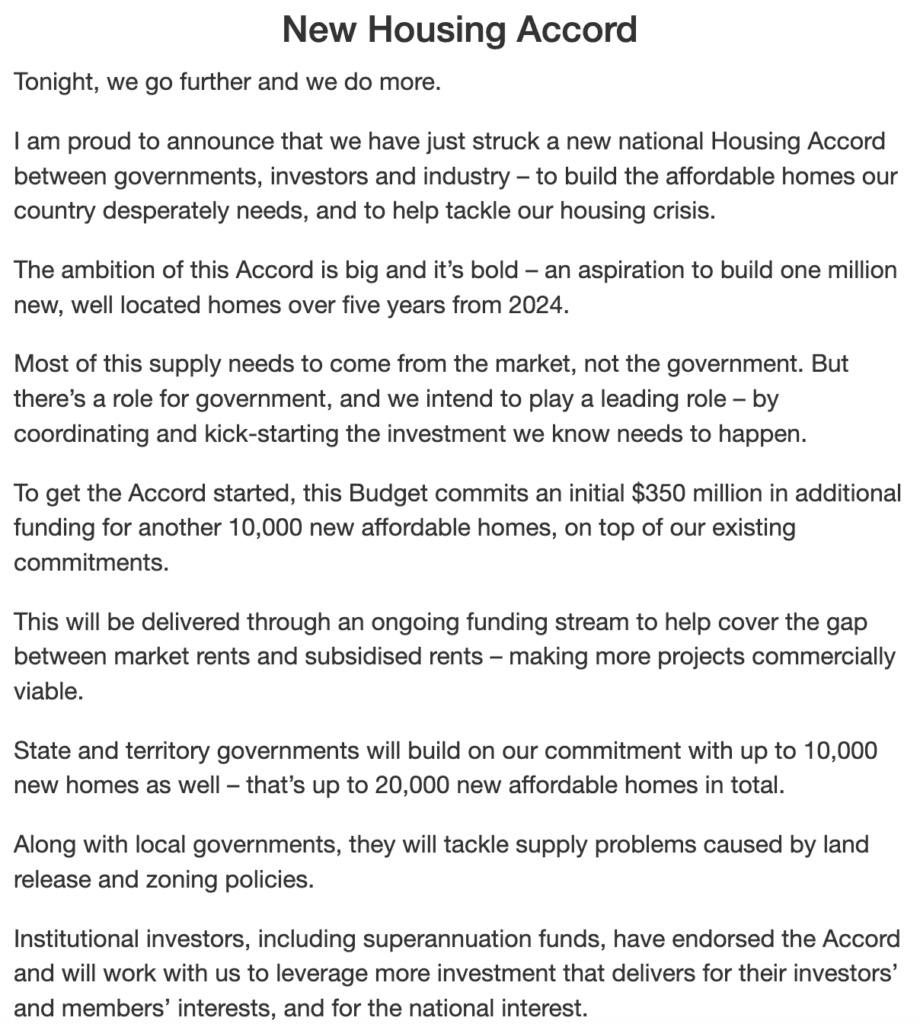

Contemplating the Housing Accord was interesting also. Considering the reliance on a suitable business model to be appealing for managed funds and superannuation throws out a conundrum.

As Pete rightly pointed out in our live chat, our government has not got an appetite for borrowing more money.

How can a fund deliver for their investors and members’ interest, when the crux of the initiative is to support the vulnerable and “help cover the gap between market rents and subsidised rents.”

Pete’s reference to New Zealand’s building rate and time invested so far within their Construction Accord is food for thought and it could be argued that the overall success is still questionable compared to their supply and demand issues also.

A policy of interest that caught my attention relates to that of subsidised childcare and an increase in our paid parental leave.

This policy will impact house prices nationally for one key reason. It will enable more women back into the work force, and for many it will likely enable many women to step up into roles that they are suited to and challenged by, as their ability to better manage their career with the financial and social support of their employer (and our legislation).

In the aspirational suburbs, property price growth is driven by demand, and demand is usually limited by household incomes and lending commitments.

With a rise in household incomes comes a rise in buying power.

While this policy will favour many Australian families, we can expect to see a direct correlation in in housing price growth in those suburbs that highly qualified, high-income-earning-potential-women live. This will also potentially give way to a secondary impact in relation to property investment willingness, (as some households will have greater surplus income with more workforce participation occurring). Although the challenges remain for our government and regulators to work out how they plan to entice private investors back into the property market.

Blind Freddy can see that the initiatives above won’t scratch the surface of the problem we face.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU