A lot of things have changed in our landscape over the past year. Interest rate increases have precipitated a new wave of buyer and vendor jitters, and return-to-work has reignited an appreciation of our city. These two, powerful elements have created significant change across our day-to-day dealings in real estate. This retrospective compares vendor, buyer and agent behaviours from 2021 to 2022.

Auction clearance rates: Auction clearance rates are currently hovering around 60% – 65% but auction volumes are down compared to last year. This Saturday, Melbourne registered 558 auctions, compared to 550 last Saturday. At the same time last year, (between awkward lockdown stop-starts), Melbourne boasted 1138 auctions and a 66% clearance rate; a strong result by any measure considering the headwinds.

Days on market: Days on market have increased into 2022. Average days on market at this time last year were 31, compared to 28 now. Interestingly, days on market were often preserved through 2021 campaigns as agents tried to discourage early offers when campaigns were running strongly. Fear of impending lockdowns did skew results, and during this time we did see agents bringing auction dates forward, encouraging swift/early offers and shortening campaign lengths.

Buyer and bidder numbers: In 2021 auction attendance was strong, and often more measurable than traditional auctions because so many were facilitated online and required buyer registration. Some auctions I participated in had over four full screens of bidders (ie. 40+) and many had more than ten active bidders during the auction. This year, auctions are broadly back to in-person, and typical bidder numbers range from 1 to 5. Many more pass-ins have resulted this year than last year too.

Property inspections: Inspecting property in between Melbourne’s harsh lockdowns was challenging (at best). One-on-one appointments were exhausting for agents and required unprecedented administrative attention. Many were time-limited, and during our total lockdown periods, savvy vendors were guided online by their agents to host virtual tours.

We adopted a policy to film and narrate every property we were permitted to inspect, as we were all too familiar with snap lockdowns precluding further inspections.

It’s hard to believe that it was only ten months ago that we were sitting at home, navigating transacting real estate remotely. These days, open homes aren’t all well-attended; a far cry from the bustling months of 2021 when long queues reached out to the street, and open-homes spanned hours.

Pre-auction offer activity: 2021 was the year of feast and famine when it came to purchase activity, and pre-auction activity was the pre-curser to lockdowns. Unlike 2022, which has been characterised by an agent preparedness to encourage pre-auction offers, 2021 saw many agents “running to auction day” when the threat of lockdown was not imminent.

Agent dialogue: It’s fair to say that we’ve seen a dramatic change in agent dialogue between the two years.

In 2021, we could anticipate a response such as this when enquiring about a campaign. “Who knows where this could land. Numbers have been strong”. Agents couldn’t even predict how aggressive their bidders would be.

“This one is definitely running to the day.”

If campaigns were running strongly and lockdown wasn’t threatening, agents were deliberate in their efforts to get a smashing result for their vendors by running the campaign all the way to auction day.

“This one is selling tonight. Are you in or out?”

The frenetic pace, exacerbated by lockdowns was exhausting. Many sales came to a head quickly and time-pressure on buyer’s advocates was enormous.

Buyer attitudes: Buyers were irrational and FOMO, (fear of missing out) was featured in every second media headline. From overpaying to overlooking compromise, many buyers threw caution to the wind and made sight-unseen offers.

“We have ten offers, sight unseen. Sorry Cate, vendor’s instructions are to sell today.”

Market segments: As we all know, the regions performed extraordinarily well. In fact, anything outside of Melbourne seemed to be in high demand during lockdown activity. Strong prices were recorded in both coastal and inland regions, and larger houses recorded strong growth as buyers opted for additional study space in a quest to better enable working from home.

In 2022, we’ve seen a sharp return to apartment life and inner-city living. This is due in part to a revitalisation of our city as it bounces back post-lockdown, but also due to adopters of sea-change and tree-change securing their little ‘city pad’ now that employers are beckoning for us to return to the office.

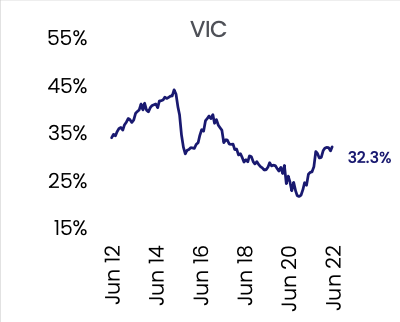

Investor activity: Investors have continued to increase since our miserable credit squeeze between 2016-2019, when investor lending bottomed out in late 2020. Numbers are up in 2022 as investors chase stronger rental yields and take comfort in tighter vacancy rates.

First home buyers: First home buyers have moved from FOMO-status to scaredy-cat status very quickly. They are the contingent who haven’t experienced interest rate increases, and as such are terrified by the media shock headlines. While many are enjoying assistance from the bank of Mum&Dad, plenty are either sitting it out and waiting/hoping for the market to drop, or cautiously applying budget-cuts to their purchase limits in an effort to buffer their risk. Interestingly though, not a very large percentage are actually impacted by reduced borrowing capacity with the rate rises because it’s typically deposit savings that restricts borrowing capacity for first home buyers, not a decrease in servicing.

Fixed rate loans: As our nation’s bond-buying slowed and ceased in late 2021, so too did our record low interest rates. The RBA’s ‘yield curve control’ enabled a large part of our run during these heady two years, however the contrast is now a fixed vs variable ratio that is more representative of historical averages. Our fixed rates currently sit above our variable rates; a standard scenario we’ve had in most climates.

Perceived risks: Last year, buyers were afraid of missing out. This year, buyers are fearful of buying before a market fall.

Vendor attitudes: Vendors who are selling are committed sellers. Last year, plenty of vendors were happy to try their luck in order to see if they could achieve a crazy price.

Both years, however hold the same challenge for vendors: “If I sell, what can I buy?”

Heady conditions made acquisitions difficult in 2021. Limited quality stock is 2022’s challenge.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU