When Bull markets turn Bear, the order of how people upgrade their home changes. This, in turn can impact stock levels, particularly when aspiring Sellers don’t like what they see.

I was asked to comment for The Age’s Domain this week about the apparent concern that our State Revenue Office has expressed in relation to diminished Land Stamp Duty tax collected in the past year when contrasted to our prior, Bull market years.

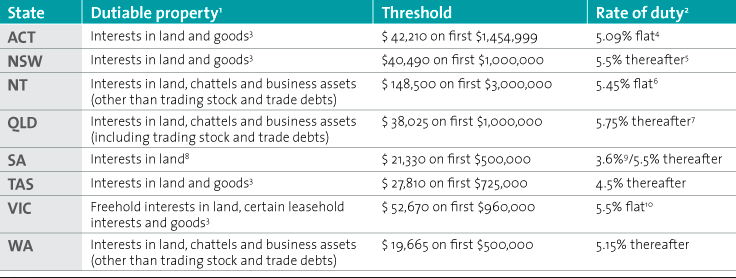

“Boo hoo” I hear every purchaser say. Me included. Our Land Stamp Duty tax in Victoria is the highest in the nation, although the discrepancy between most states with the exception of SA and TAS) is not all that large. Circa~5% is the broad-brush amount* a buyer needs to provision if they are upgrading, down-sizing, or investing. It’s a tough tax for many.

The issues with Land Tax are numerous though.

Firstly, the tax is not consistent among all buyers*. The absence of, (or subsidised amount of), Land Stamp Duty for eligible first home buyers up to a specific figure has segmented our market. Stock priced in this contingent’s spend-range is considerably more competitive than $750K+ properties.

It could be argued that the introduction of this valuable waiver created an artificial price hike for the genre of properties impacted by the First Home Buyer Stamp Duty Concession. The capital growth disparity between houses and units in the period since the full concession was introduced demonstrates what occurred in Melbourne when the Victorian Government doubled the concession in July 2017.

Unit price growth outstripped house price growth for the twelve months that followed.

The other contingent who face a differing stamp duty treatment are foreign buyers. An additional 7% hike certainly adds some funds into the SRO’s coffers. Not to mention the Vacancy Tax that foreign buyers contribute when their inner, or middle-ring asset is devoid of an inhabitant.

Regardless of whether we think it’s appropriate or not, this tax can be very confusing. Throw different Visas and Kiwi’s into the mix, and solicitors will still scratch their head come settlement time.

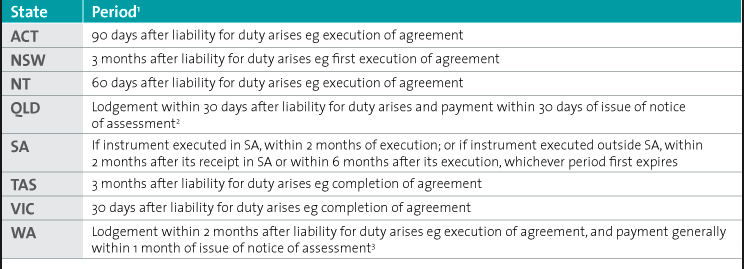

Secondly, the tax is payable immediately (unlike HECS debts that are capitalised on low interest rate arrangements and paid off over a long period of time).

The impact of this upfront cost affects several categories of buyers as follows;

- Home buyers who are ineligible for the concession, but entering (or re-entering) the market will either face a delayed purchase while they save additional funds, compromise on the purchase criteria in an effort to get into the market, or put off the idea while they continue to rent.

- Those single buyers who have faced a separation will have their sales proceeds eroded by the tax. In combination with their equity being halved or segmented as they wade through their legal separation, the added cost of Land Stamp Duty will likely limit their next purchase options.

- Renovators and flippers will reconsider the feasibility of their plans, and/or the timing of their sale based on the fact that the Land Stamp Duty will erode their profit margin.

- Growing families will turn to renovating as opposed to upgrading.

- Down-sizers will sit tight for longer.

- In a slowing market, investors will be limited by their equity position and will be less likely to purchase subsequent properties, as the added cost of the ~5% impacts their ability to cover the minimum bank deposit required.

It is considered a costly tax to our economy due to the adverse impact it has on those who could move for productive reasons, but choose not to due to the tax implication. The Grattan Institution have reported on this issue, citing the following;

“They make it more expensive to move home, to take a new job across town or in a different town, encouraging people to stay put. They make it more expensive to move into bigger or smaller homes, encouraging people to renovate instead. “

So how relevant is the issue of lesser tax revenues in this market correction?

Has Land Stamp Duty caused our correction? No, credit tightening has.

The issue we currently face is exacerbated by this very tax.

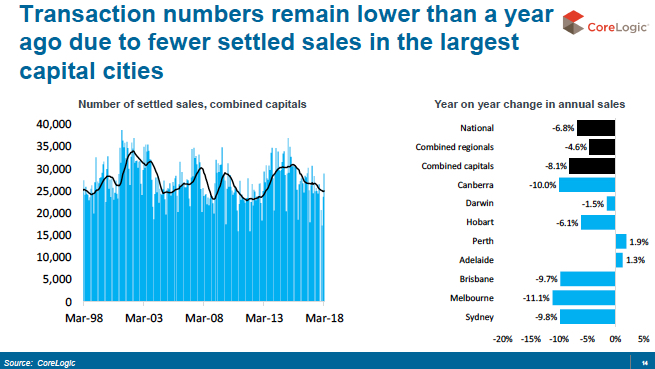

The lower stock volumes have slightly increased our Demand:Supply Ratio, but the lower sales volumes are particularly evident in Melbourne and Sydney.

Most aspiring Sellers are either choosing not to sell until the market demonstrates gains, or until they can secure a suitable upgrader property. With low stock levels, the latter is considerably more challenging for them.

No Vendor in Melbourne is selling right now unless they have to. This is not an aspirational market to test buyer interest in.

The looming Federal Election has also contributed to a ‘wait and see’ attitude among buyers, as elections always do.

….and so the issue continues. A classic case of chicken and egg.

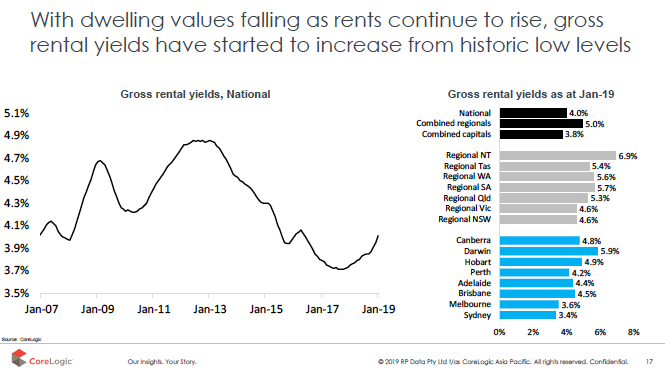

There is an adverse effect for renters and landlords to note while this lull in selling activity is transpiring. Rental yields are increasing.

Interesting that many are concerned by Labour’s plans for abolishing negative gearing. In the face of our current market changes when profiled against the heady growth of 2015, it will be intriguing to see how a new Government will broach their old election promise. It could be argued that now is not the right time to throw further cold water on the market.

Rising rents will hurt the very people they seek to protect.

I wait with interest to see what a new Government could choose to do, when they could implement changes, and how adaptive their new policy promise could be, given the 2015 market that they announced promises in feels vastly different now.

Whatever happens after May, we know that this market is presenting purchase opportunities that were not available to buyers eighteen months ago, including stronger rental returns and tighter vacancies for investors.

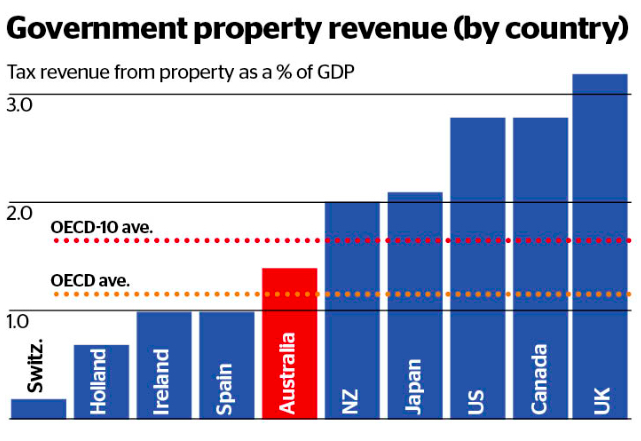

And on an aside, when we benchmark our own property tax system globally, our tax suddenly doesn’t seem quite so bad!