When it comes to property selection, it’s often the things we reject that help formulate a good investment decision.

Aside from being mindful of tenant appeal and owner-occupier appeal of a property, we must always be mindful of lender appeal.

In this competitive environment, particularly now for First Home Buyers who find themselves competing hard against each other, the quest for inner-suburb living is challenging for most. We often see buyers (investors and owner-occupiers alike) scrambling to identify apartments in highly prized suburbs within their budgets, but one compromise which doesn’t often play out well relates to internal floor area.

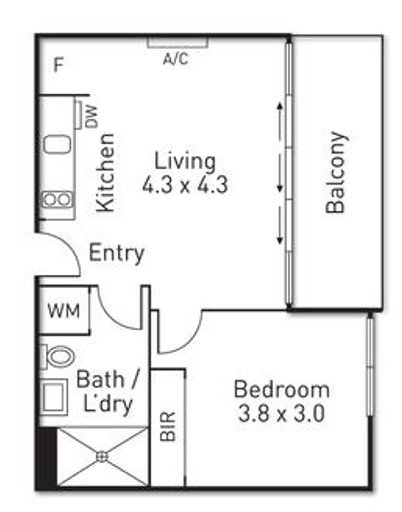

One bedroom apartments may suit the buyer’s lifestyle or criteria, but if the apartment is less than 50 square meters in size, a buyer with less than 20% deposit on hand may struggle, and the struggle will be significantly moreso if the apartment is less than 45 square meters in size.

Buyers often misunderstand the implication of signing a contract for a property with an internal floor area below 45sqm.

Lenders have determined their policies for specific reasons. They have obviously adapted the floor area policy for apartments to hedge against risk and volatility. Buyers who don’t carefully measure this space can put their own pre-approval into jeopardy. They must also understand the rules around how the space is measured. Balconies, eaves and car spaces are not counted.

The implication for those who do find themselves with a contract on a property which does not meet the Mortgage Insurer’s guidelines can range from the need to ‘find’ the additional deposit to reach 20%, or to forfeit the deposit and walk away from the sale (and potentially face damages if the vendor decides to pursue their losses).

Being cavalier about floor area on a one bedroom apartment is dangerous.

Aside from the immediate concerns associated with financing the property, buyers must also consider the re sale potential of the property and in particular, the effect on capital growth, bearing in mind that a mainstream, 90% LVR buyer cannot buy a comparable unit in the same block. If mainstream buyers can’t easily finance an asset type, the comparable sales will be limited and low compared to mainstream style properties.

The property might be a bargain, but it’s a bargain for a reason.

Take this one bedroom, one bathroom unit without a car space in ever-popular South Yarra as an example. The price tag of $285,000 for this location seems very exciting, but no doubt this property would have been outside of normal lending policy, hence the low price.

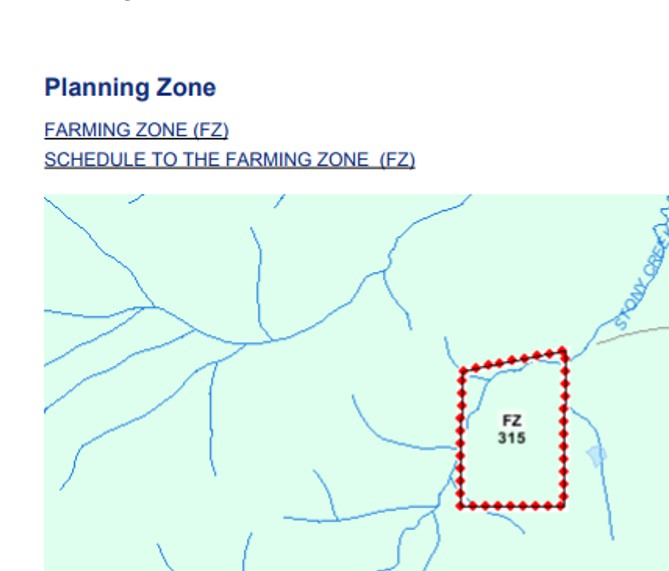

The same applies for different zones. Banks and mortgage insurers don’t just accept an alternative zoned property. Pre-approved buyers are generally pre-approved to purchase a property which meets the lenders policy guidelines. It is fair to say that most residentially zoned properties make the grade. But it’s the different zones which can sometimes be problematic.

Some commercially zoned properties may look quite residential, but lenders will determine how they wish to assess the security. Any buyers who are considering such a property should really protect themselves with a finance clause.

And for those who love the idea of a tree change, acreage needs to be carefully examined. Zones which include Farming or Rural can trigger a much higher degree of scrutiny than standard houses in the area. If in doubt about the zoning of the property, a thorough legal review of the Contract of Sale will clarify the question.

Some such properties restrict lending to just 60% of the value which means that buyers need to approach the deal with a 40% plus stamp duty position before getting serious about buying the property.

It’s never fun telling prospective buyers that their dream find may be too hard to finance, but it’s far nicer sharing our concerns before the contract is executed, than after.

Careful selection, adherence to lending policy and thorough contract reviews are essential.