Sunday Blog

Buying at the bottom of the market cycle

This is such a dilemma for so many. In principle, it sounds so good. If only we could have the courage to do so, yet most don’t. All of the market leading indicators in the world won’t take away from the fact that when a market has fallen, prospective buyers are generally more fearful of…

Read MoreChoice paradox: a threat to buyer success

In our role as advisors, we see all kinds of human behaviours in our clients along their varied journeys. Some behaviours are enablers, some are just part of the process, and others are disablers. One critical disabler relates to the inability to make a decision, and this disabler can grip for many reasons, including third…

Read MoreWhat can make a property a lemon?

We hear this word often in the pejorative and the idea of it applying to a property can leave any investor or home owner feeling quite despondent. There are many elements that can contribute to devaluing a property or creating stress for the owners, and depending on the owner’s risk appetite, cash flow, experience and…

Read MoreThe biggest threat when a property passes in

A pass-in auction result is more prevalent in a softer or declining market. There are all sorts of tips and ideas that I can share when this results, but all of the advice on the planet won’t help a buyer if they are letting their own fears threaten their strategy. I often say to our…

Read MoreThomastown, Melbourne

We are actively assessing the rate of change of demographic data, and as we approach our most recent Census data-release date, we are a bit gripped with excitement to commence yet another hefty round of suburb analysis. Over the past decade we’ve combined our coal-face observations; from organic buyer demand increases and attitudinal changes from…

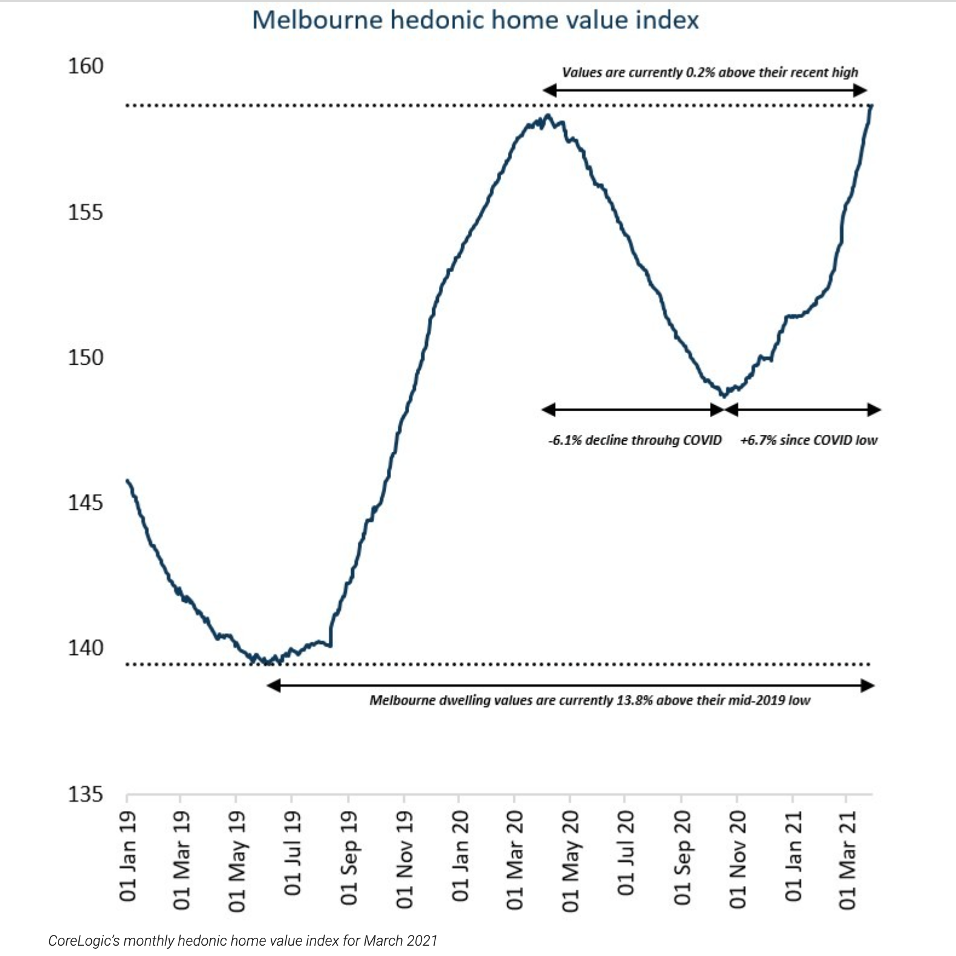

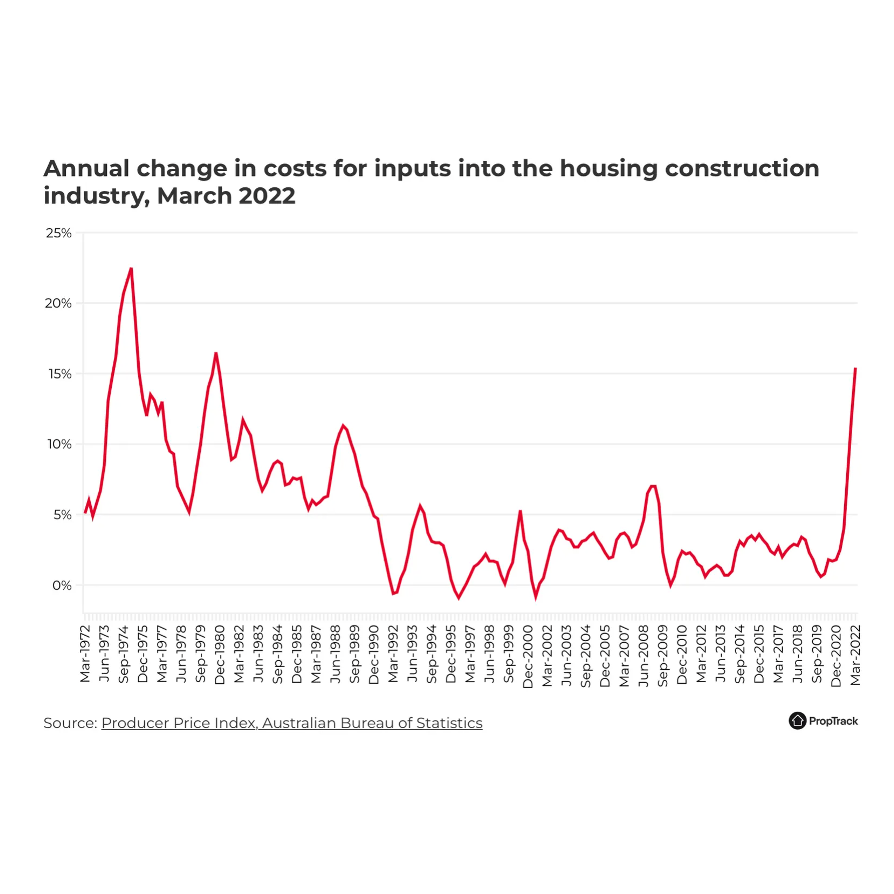

Read MoreWhy property values won’t plummet

There is so much talk of doom and gloom in the media and it’s making it very difficult for many buyers and sellers to make informed decisions. Bad news seems to sell papers. Since our first interest rate rise in eleven years, the most commonly asked question I’ve been fielding is, “Cate, is it a…

Read MoreLooking back on my own investing journey

It’s easy to find fault in our individual investing journeys, particularly when we consider all of our valuable learnings over the decades and reflect on some of the early decisions we made. A number of my own acquisitions were made preceding my time as a buyers agent and I often reflect on the things that…

Read MoreMaking a move across town

So many people have done it, my little family included. Back in 2012 we made the bold decision to shift our life from beachside Aspendale to inner-west’s Yarraville. The move was not a consideration we took lightly. Our friends, my husband’s work, our daughter’s school, my family… they were all around Aspendale. But after a…

Read MoreHow are 2022’s buyers different?

We’re all familiar with the various ways that lockdowns and COVID-19 shaped our preferences and criteria when it comes to selecting real estate. Some of those changes have been hallmarks of the era, while others are more permanent. But 2022 is different for various reasons. We have conflict in Ukraine, supply chain woes, inflationary pressures…

Read MoreHow do interest rates impact capital growth?

For ten days now, I’ve been asked this question. I’ve reflected on the stark contrast between this month’s consumer reaction to a 0.25% rate increase, versus our reaction to such an increase in the years that consecutive rate increases were applied. For owner occupiers and investors alike, as much as we didn’t like the rate…

Read More