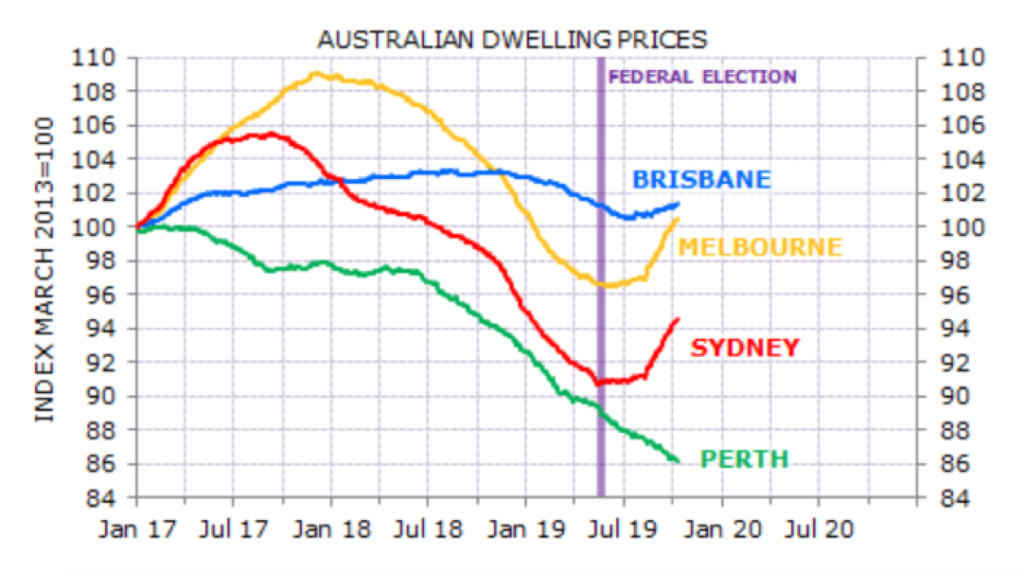

2019 has been an unusual year indeed. As stated last week by a auctioneer, it’s been a year of two distinctly different halves. The Federal election augmented our year on May 18th, and along with the surprise result came a surge in positive sentiment, pent-up intent to buy, and stronger capacity to do so with rate cuts fuelling increased borrowing capacity.

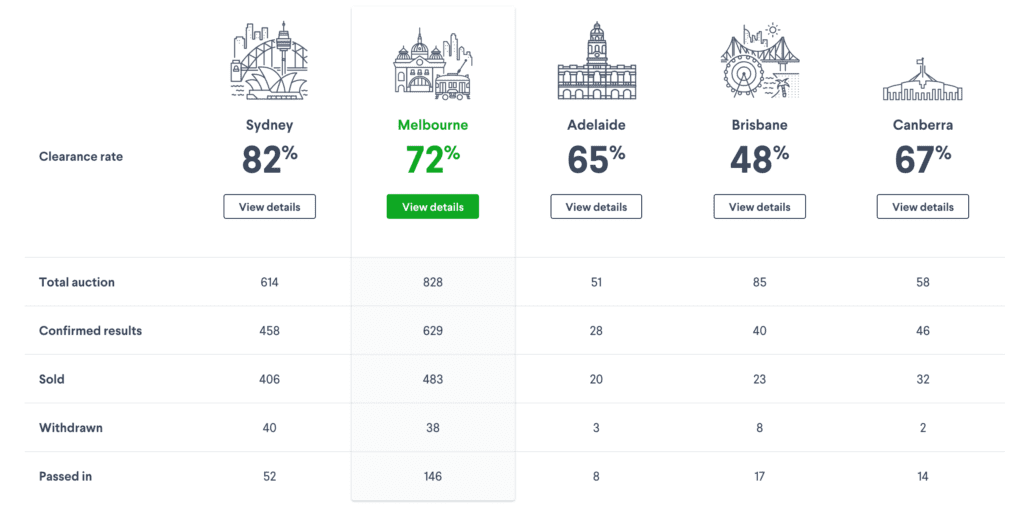

Yet, even with larger stock volumes on offer this Spring, buyers are finding it very difficult to secure property.

Competition is really tough.

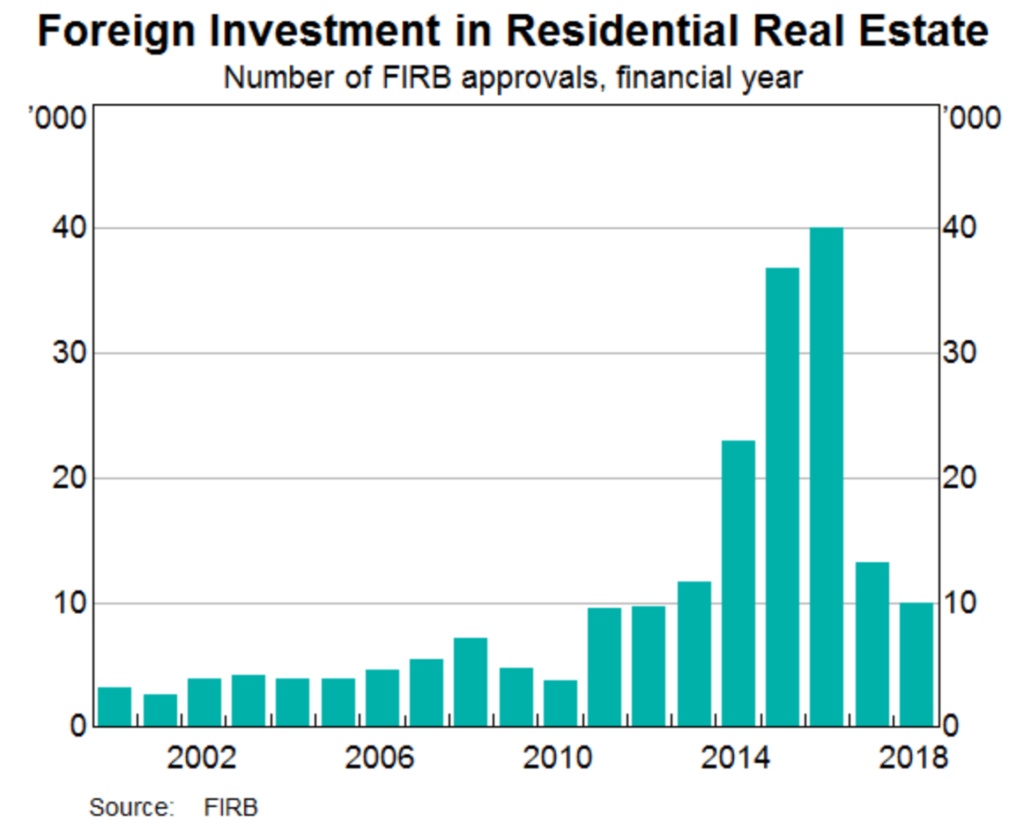

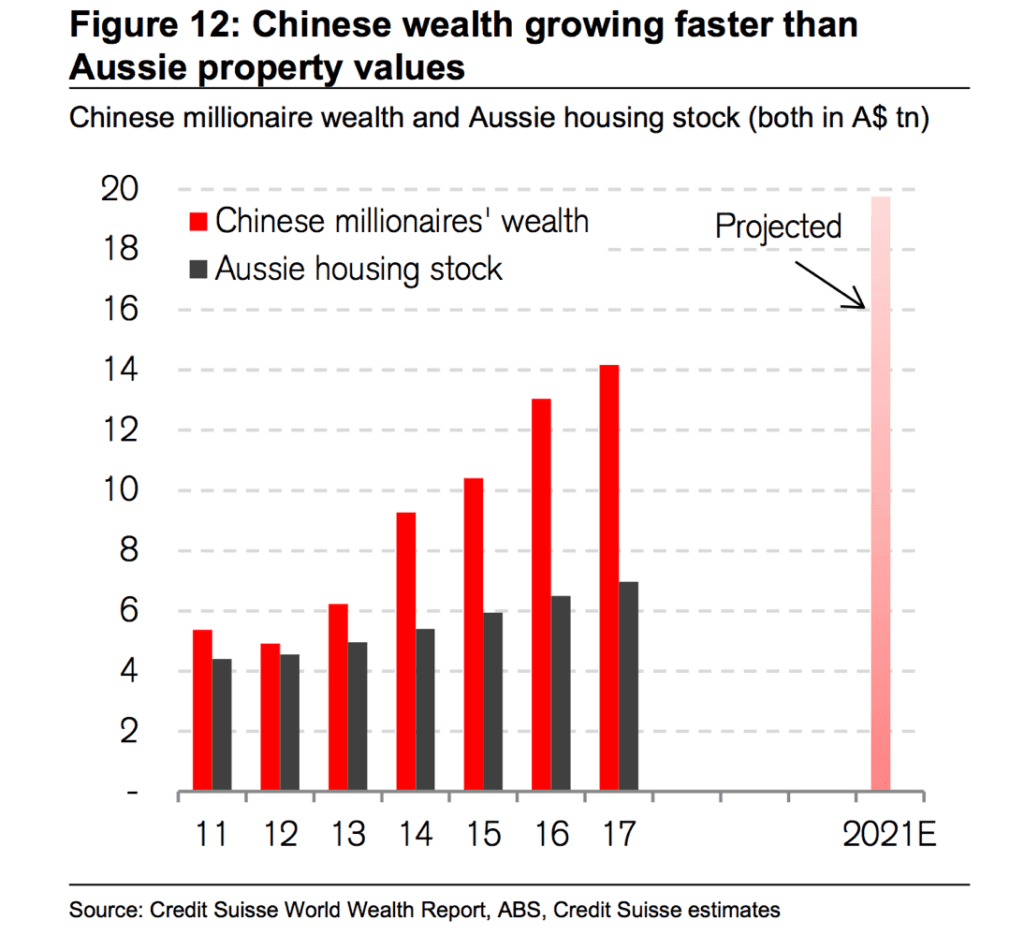

So who are the buyers that are challenging the mainstream every auction Saturday? We can’t keep blaming the Chinese. Since introducing new taxes for foreign buyers, (specifically higher stamp duty fees and the vacancy tax), and restricting many foreign buyers to new stock via stricter FIRB rules, our number of Chinese buyers, (and other foreign buyers) has dramatically decreased.

Decrease aside, they are still a formidable force and this chart by Credit Suisse demonstrates the pace of Chinese wealth when contrasted against Australian property values.

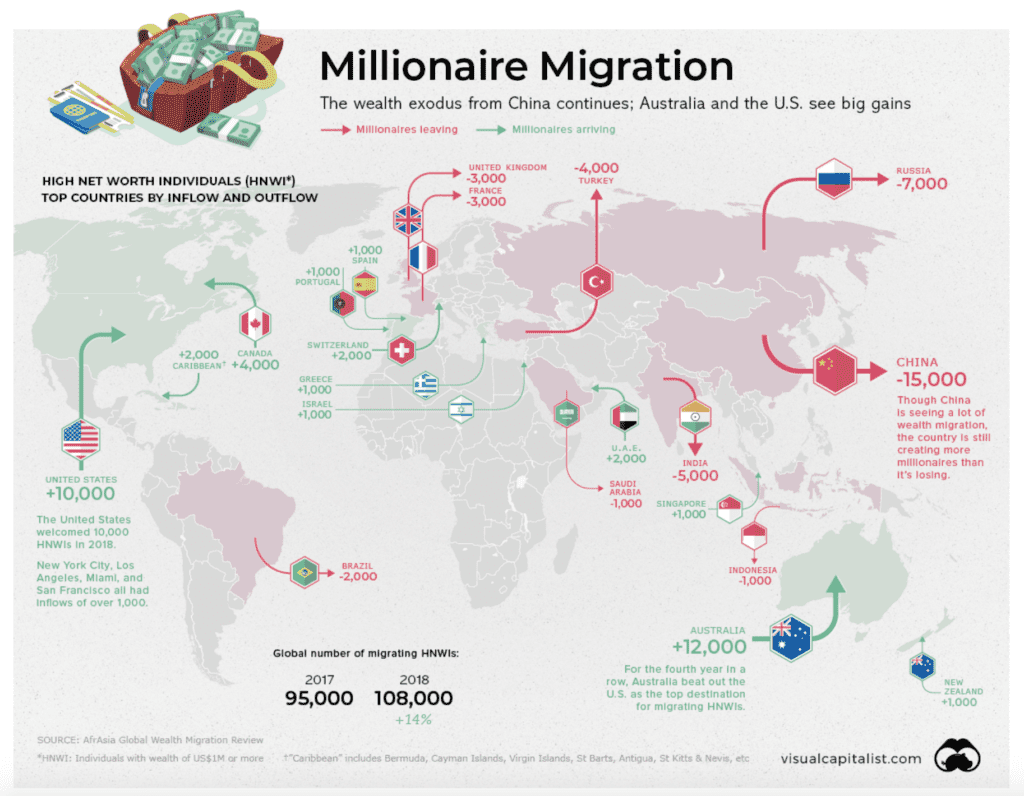

Migrating millionaires are one segment of the population that are interesting to understand. This chart shows the sheer strength of wealthy arrivals into Australia and the contrast against other countries is notable.

However, the force we are experiencing at the coal face is local one.

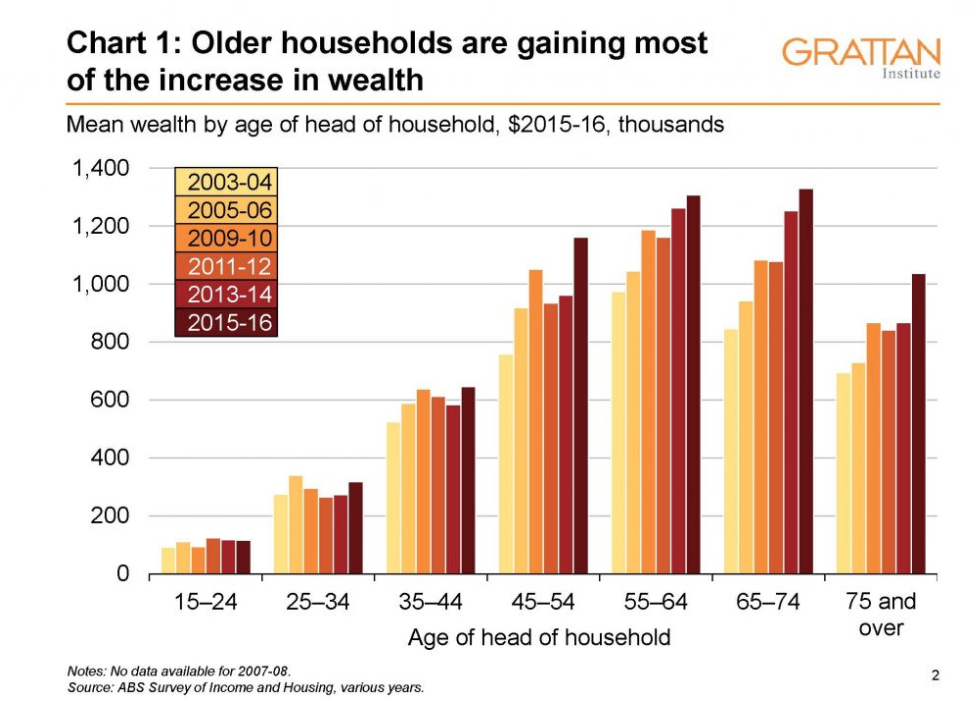

Older buyers, down-sizers, baby-boomers, empty-nesters, retirees… we can term them with a few descriptors, but it is evident that many of our inner-ring property auction losses are at the hands of a more mature generation.

“Data from the Australian Bureau of Statistics (ABS) shows that older Australians are capturing an increasing share of the nation’s wealth, and the house-price boom is a major cause of the growing divide between the generations.

As you can see in the (above) chart, households headed by 65-74-year-olds were on average A$480,000 wealthier in 2015-16 than households in the same age group 12 years ago. And that’s after taking inflation into account and despite the damage caused by the global financial crisis. Households headed by 45-54-year-olds are A$400,000 richer.” Source

Our recent auction experiences have delivered lower success rates, (understandable in a rising market) and in almost each auction loss we have noted that older buyers or those with parental help have taken the keys.

Just last weekend we watched six mature bidders all fight it out for a house in Canning St, Carlton North. The reserve price was announced at $1.38M yet a further fifteen minutes of bidding took the sale price to $1.75M, a figure completely unjustified by any comparable sales analysis measure.

The valuation shortfall issue is obviously not of concern for a buyer who is not impacted by a shortfall. Low Loan to Value Ratios or cash purchases eradicate any concerns about valuation dilemmas.

One lucky daughter received a generous gift last month when her parents decided to shout her a home. Unlike a holiday, or early HECS repayment, or perhaps a first car, many parents are taking their generosity one step further.

This wealthy older contingent is a very real force, and one that is not likely to go away soon.

Buyers need to be cognisant of competition level on a particular property, (and the strength of the competing buyers) before they invest emotionally and financially in their due diligence.

We almost always establish this information in advance through specific questions to the selling agent, competing agents and recent past auction observations in the area.

Credit to Tim Boyle for providing some thought-provoking charts in his early Sunday email, and Nelson Alexander’s blog.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU