What are they? When are they most common? Which markets support them? What do buyers get wrong? …. and why do so many people fear them?

This week marked an exciting week in Boardroom Auction Land. We had not one, but three boardroom auction scenarios we faced in the space of just 24 hours. The notice periods were relatively short for each, and the outcomes all varied, but they all had one thing in common.

They all received an offer that was deemed acceptable to the vendor, and each had multiple interested buyers lurking.

However, was their differences that were interesting.. Each outcome varied as a direct result of the number of participants and the decisions each made to compete for the property under boardroom auction conditions.

First and foremost, though; it is important to define what a boardroom auction is, why they are adopted by so many agents, and how boardroom auctions are facilitated.

Boardroom auctions are different to auctions.

Auctions have a publicised date and are scheduled for around four weeks. An auction sale is bound by auction rules. In Victoria, our auction rules span the three business days prior to; and following a public auction. Buyers are not eligible for any cooling off period when a property is purchased in this date-range. Bidding activity is governed by strict auction rules and all auctions commence with an auctioneer reading the rules to the crowd.

A boardroom auction is not necessarily held during the auction period (ie. within the three days of a publicly scheduled auction). The auction rules do not apply, and the agency can host the simulated auction however they decide to.

For all intents and purposes, the sale is a private negotiation with a splash of transparency.

Yesterday’s three scenarios came to a head very quickly and quite dramatically. The first boardroom auction was held at an agency office in Williamstown for this character, renovated gem adjacent to a pub. I was representing two home-owners who weighed up the adverse impact of the pub and decided to employ me to negotiate for them. Despite the compromised location of the property with a beer garden behind the kitchen wall, the lack of alternative properties for sale underpinned some strong interest on this particular sale. Three others bid and I merely observed. The reserve was $1.4M and the resultant sale was $1.627M.

The gorgeous period house next to the Stag hotel

My second boardroom auction was in Kingsville and I was again representing a lovely family who employed me to bid. After weighing up the vendor’s expectation, the comparable sales and the likely competition we elected to submit an offer just below the top of the quoted range. The agents made their phone calls and established that there were two of us who were prepared to fight it out. While the rain smashed down and the vendor sat upstairs, we arrived at the property at 5.20pm in preparation for a 5.30pm deadline only to be told that our competition had experienced a change of heart at the last moment and wouldn’t be bidding.

Secured late last night in the rain

We proudly started signing contracts at that point.

The third scenario was interesting indeed. We had identified a two bedroom single fronted little gem in Yarraville for an investor client of ours and despite the fact that it was off-market, one other buyer was also aware of it and fighting us for the keys. We opted to move swiftly and met the vendor’s expectation for a price that we felt was attractive for our buyer. Our competition also landed on this same price but our intel suggested that they couldn’t offer a short settlement. Our thirty days’ settlement offer meant that our offer was favoured. Given the opportunity to have a boardroom auction to fight it out, the other buyer chose not to participate by the 5pm deadline for whatever reason.

By default, the keys went to us.

But why would a buyer shy away from a boardroom auction? We see many situations where buyers avoid a boardroom auction and they are wide-ranging but often fit within the following reasons:

- Finance is not yet ready because they anticipated they would have the full auction campaign period in which to finalise the pre-approval

- Assuming that the price will fly past their limit

- Skepticism about the agent’s motivation or conduct with such a sales method

- Doubt that it is actually going to happen (ie. assuming it’s an agent bluff)

- Lack of familiarity or confidence in the process

- Fear of bidding in a small room where opponents are up close and/or intimidatory

- Inability to make it to the boardroom auction at short notice

- Time-restricted to complete the final due diligence at short notice

- Another property is going to auction imminently that would have been the buyer’s first preference

We have had some spectacular success over the years with boardroom auctions, particularly when our swift and ‘acceptable’ offer has triggered a competitive fight with less players than we could have anticipated on auction day.

The interesting element I note about boardroom auctions is the prevalence of them in a particular point of our market cycle.

They tend to occur the most in between a transition from a Buyer’s Market to a Seller’s Market. In layman’s terms, this is during the period following house price falls and a general house price increase.

A busy auction crowd in Melbourne last weekend with multiple bidders

Specifically, it is a true reflection of the imbalance of emotions felt by sellers versus buyers. Buyers know all too well how a growing Seller’s market feels because they will be experiencing heightened buyer competition, rising auction clearance rates and they may have even missed out at auction themselves. Vendors who haven’t been out at auctions (why would they? if they are selling and disinterested in traipsing around to auctions, they won’t bother) won’t yet appreciate the changing market conditions because our data-lag restricts the flow of immediate feedback from the coalface.

These vendors are more likely to be fearing the recent Buyer’s market conditions they’ve become all too familiar with due to negative media reports.

They will still be feeling vulnerable and hoping for a fair price.

In between the negative media sentiment and the reports claiming that the property market is bouncing back with a solid return, three things are more likely to happen;

- clever buyers will trigger a pre-auction sale with an offer that meets (but doesn’t exceed) the vendor’s expectation

- vendors will take an acceptable offer quickly, in fear of the buyer disappearing and/or changing their mind

- agents will find that competing buyers are prepared to fight for the property… hence a competitive bidding scenario like a boardroom auction will ensue.

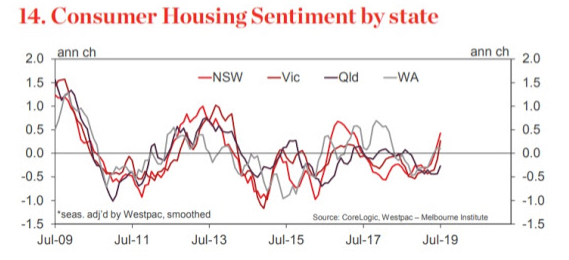

An interesting chart that illustrates current buyer sentiment beautifully is this one shown below from Westpac, and aptly narrated by Pete Wargent:

“Westpac’s Red Book for July 2019 revealed a mixed picture, with troubling consumer sentiment still stuck at below average levels.

Housing sentiment has shown a much clearer response to lower interest rates.

The ‘time to buy a dwelling’ index increased again in the 3 months to July and is now 36.8 per cent higher than the mid-2017 nadir to sit at above average levels, led by New South Wales and Victoria.

But the biggest change in response to the election result and interest rate cuts has been to house price expectations.

The house price expectations index has jumped 33.5 per cent higher in only two months between May and July.

Westpac’s composite housing sentiment index has historically been very good at picking turning points in housing market turnover.

There’s some downwards pressure on the composite index due to modestly rising unemployment expectations, but overall sentiment is at the highest levels since 2015 and trending sharply higher.” – Pete Wargent Daily Blog

Boardroom auctions are to be revered, not feared… but the timing must be right and the vendor and agent must be willing to sell. Trying to force an acceptance of offer prior to auction when the vendor and/or agent is determined to run to auction is a dangerous ploy.

All you’ll be doing is showing your cards and underpinning a reserve.

Enjoy our Boardroom Auction Video here

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU