Our auction bidding list this weekend featured a combination of houses and units…. units of varying style and size, but well-located, beautifully proportioned and enticing for tenants and home-buyers alike.

Sadly for two particular clients, their hard work, patience and due diligence didn’t pay off yesterday and we were mildly surprised by the strength of the day’s auctions. With a clearance rate as at Saturday night of 78%, the competitive conditions we felt at the coal face were explained by strong auction figures; a sign that supply is still lower than demand.

What was interesting to note was the growth trajectory of two properties in particular.

We bid on this superbly orientated, well-designed townhouse on 159 sqm, situated in the heart of Yarraville’s village. Boasting two beautiful bedrooms and a mezzanine study area, this amazing townhouse sold under the hammer yesterday for $960,000. Despite the fact that this modern style sits in a sea of period Victorian-era houses, yesterday’s price tag reflected a sale price which compares to those for 2BR Victorian cottages on the same land allotment.

Four bidders (including us) fought it out; testament to the popularity of the property and what it offers a broad range of buyers.

Meanwhile across town, we bid on this beautifully-renovated villa unit on 96 sqm in Bayside’s Black Rock. Second Avenue is conveniently close to the heart of the shopping village on Balcombe Rd, and an easy stroll to the gorgeous beach. This 1970’s built unit in a tight block of just four last sold in July 2012 for $450K. Not overlooking the work which the current owners have done to enhance it, this represents a circa-15% year on year average capital growth;

…an impressive growth rate by anyone’s logic.

Many investors have a misguided idea about units and often they emphatically come to us and tell us “I’m not interested in a unit. It must be a house on it’s own block.”

I’ve seen plenty of sad cases over the years where investors have either targeted new house and land package offerings in the fringe outer areas in the hope for capital growth, or worse-still, tax benefits. So many of these investments have been problematic in terms of tenant quality, vacancy rates and limited growth. Without naming suburbs, I often tell investors that I’d rather target a great villa unit in the 10km radius over a large house on a full block some 30km out.

There is little debate that all things being equal with land value, a house will outperform.. but all things are not often equal. Houses are unique, blocks are unique and different suburbs offer different price-points based on land value. Importantly, it is vital that growth drivers are considered, target tenants are factored in, vacancy rates are understood and age of the property is known.

All of these things can affect the growth prospects of a property, and I could cite hundreds of examples demonstrating a unit’s growth outstripping a house’s growth. This unit in Black Rock is a great example of an out-performance asset. It is well-located, appealing to a wide array of buyers, popular for tenants, well built/renovated and is in the heartland of a strong-household-income demographic.

In addition to all of these positive factors, the property is not too new.

The age of the dwelling has enabled the property to grow more aggressively than a similarly priced new property in the same neighbourhood because a greater proportion of the property value is now encapsulated by the land component. It is land which grows, not dwellings, but the land has to be in a great location too.

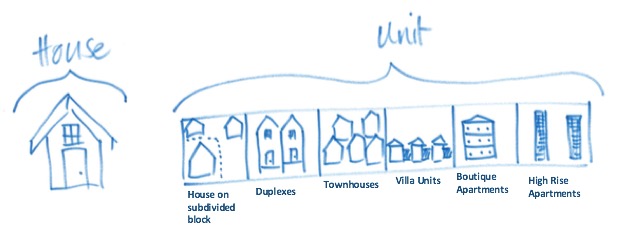

When considering units, what is commonly overlooked in our industry is the breakdown of units. By definition, a unit is a strata property on a subdivided block, but unlike houses (where a house is a house, regardless of block size), units come in all shapes and sizes. From houses on subdivided blocks, through to townhouses, villa units and apartments, we can’t generalise a unit’s performance without segmenting this property type further.

This little illustration touches on the breakdown of units and highlights why ‘median unit price’ is not reliable information.

Just because the data may state x% pa for units in a given suburb, it doesn’t mean that a townhouse will perform at the same rate as a new high rise apartment… yet they are both considered units. Investors who assume data is always reliable are naive. These two examples which we missed at auction yesterday illustrate the need to segment the unit market and understand the properties at a far deeper level than just ‘unit’.

Units have copped a hard rap of late, and for unjustified reasons. We read about an oversupply of new high-rise apartments in the Docklands on a daily basis, but this does not mean that units are a bad investment. For those who apply the right principles to their search, units like these above can provide exciting returns, great tenants and out-performance growth.

Obviously we aren’t the only ones who feel this way. We had tough competition on both properties at auction yesterday…. a reminder to us all that some units are fantastic and highly coveted.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU