Melbourne has faced some tough headwinds since the pandemic.

The tough lockdowns saw strong internal migration, both from our capital city to other states, and from our city to our local regions. The chart below shows Melbourne’s arrivals and departures during three data collection dates during the COVID pandemic.

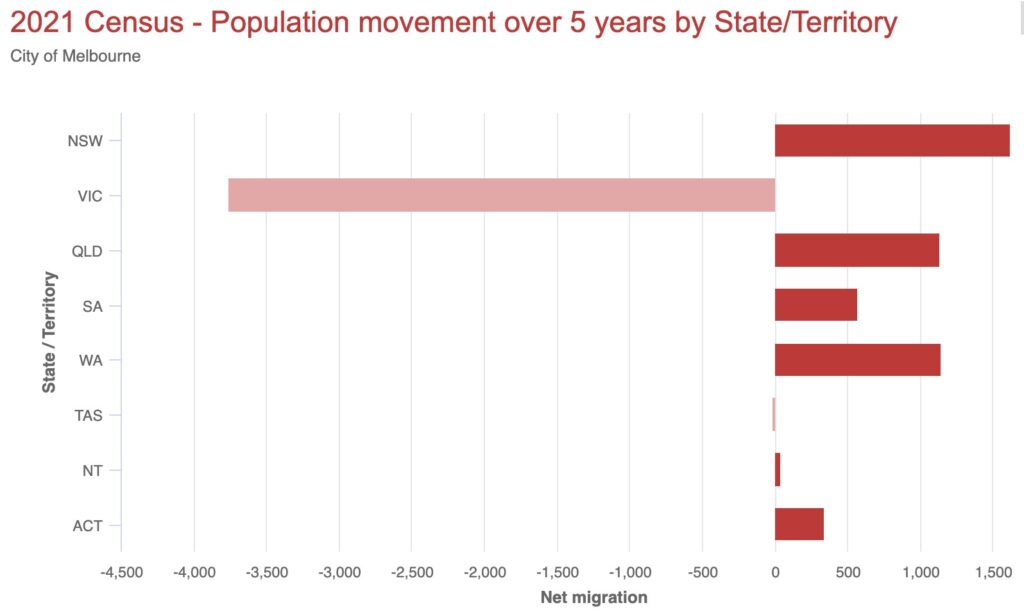

The Census chart below shows the interstate internal migration during the five year period from 2016-2021. Victoria’s net loss was close to 4,000 people.

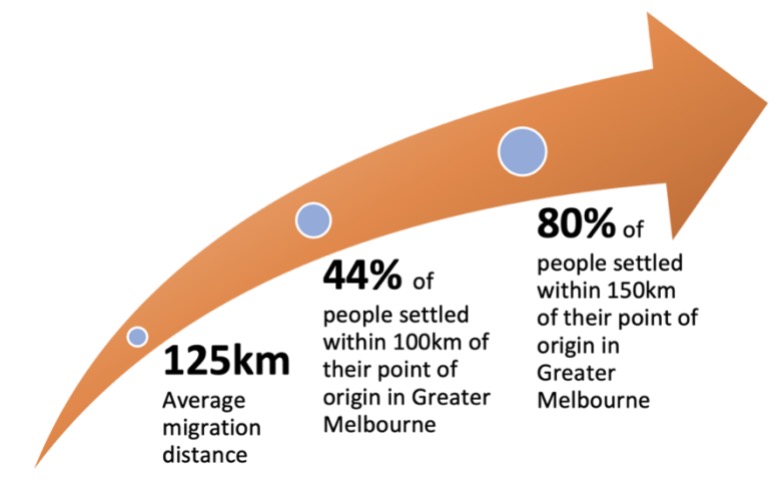

The vast majority of Melburnians who chose to move to regional Victoria during the pandemic selected regions within a two hour commuting distance.

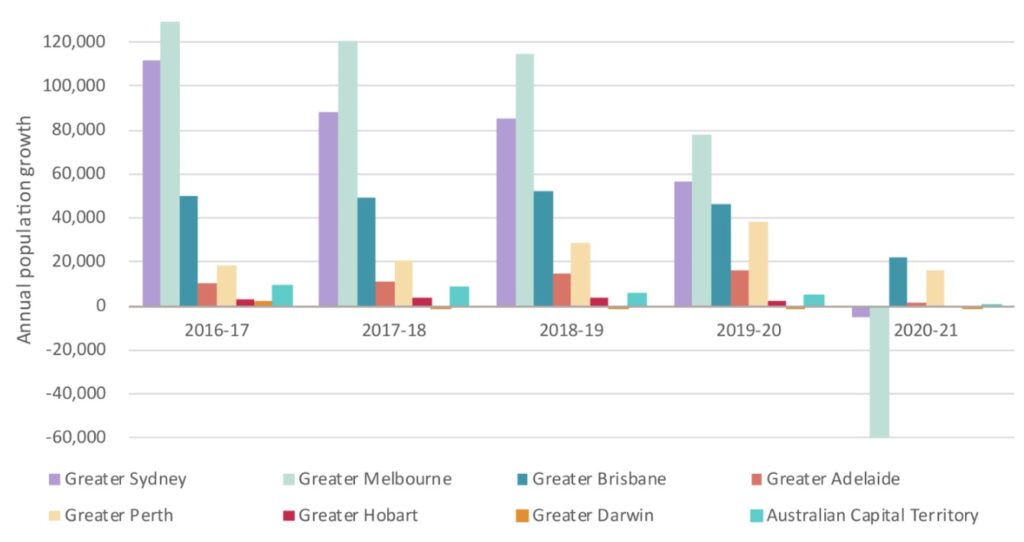

And for a city that has historically experienced strong numbers of new arrivals, the pandemic altered everything temporarily.

“National net overseas migration changed significantly following the COVID-19 pandemic, decreasing from 263,000 in the financial year 2016-17, to -88,000 in 2020-21. This was driven by a significant decline in temporary visitors, students, and working holiday visa holders.

This reduction in net overseas migration impacted Melbourne and Sydney most significantly. 85 per cent and 67 per cent of their population growth between 2016-2020 were contributed by net overseas migration respectively.

Reductions in net internal migration also significantly impacted Melbourne and Sydney. Melbourne’s population decline of 60,500 was made up of 54,400 overseas and 33,500 internal migration losses against natural growth of 27,400. Meanwhile, Sydney’s population decline of 5,200 was made up of 7,200 overseas and 34,800 internal migration losses against natural growth of 36,900.” (Source: SGS Economics and Planning, March 2022)

Our city suffered during this time as businesses closed and international students returned to their home country. Interestingly, our record low, emergency-based interest rates kept buyers enthused. And the mandated work from home phenomenon changed our preferences for housing attributes entirely.

People needed an extra bedroom or study, and interest rates were so low, many could afford it.

Our capital city’s capital growth rate was extraordinary, particularly considering the rate of city escapees and the challenges associated with buying property in a lockdown environment. However, once the RBA put the brakes on by increasing our interest rates, things changed quickly for Melbourne.

Other cities and regions continued to flourish, namely Adelaide, Perth and Brisbane. The combination of remote working conditions, increased housing/living costs, higher taxes and onerous rental reforms on investors, increased property listing numbers, and concerns about economic prosperity have been some of the reasons why our city has underperformed of late.

However, it’s important to consider the possible drivers that could bring buyers back to Melbourne. Our city has recovered socially since the pandemic. Events are back, sporting continues, and plenty of visitors are enjoying all that Melbourne has to offer.

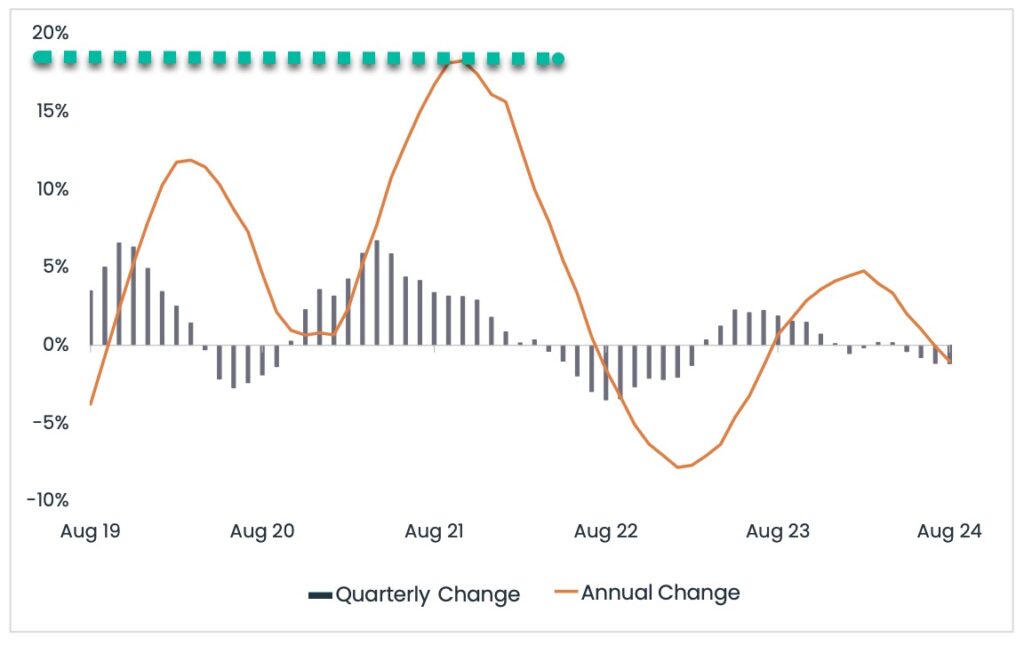

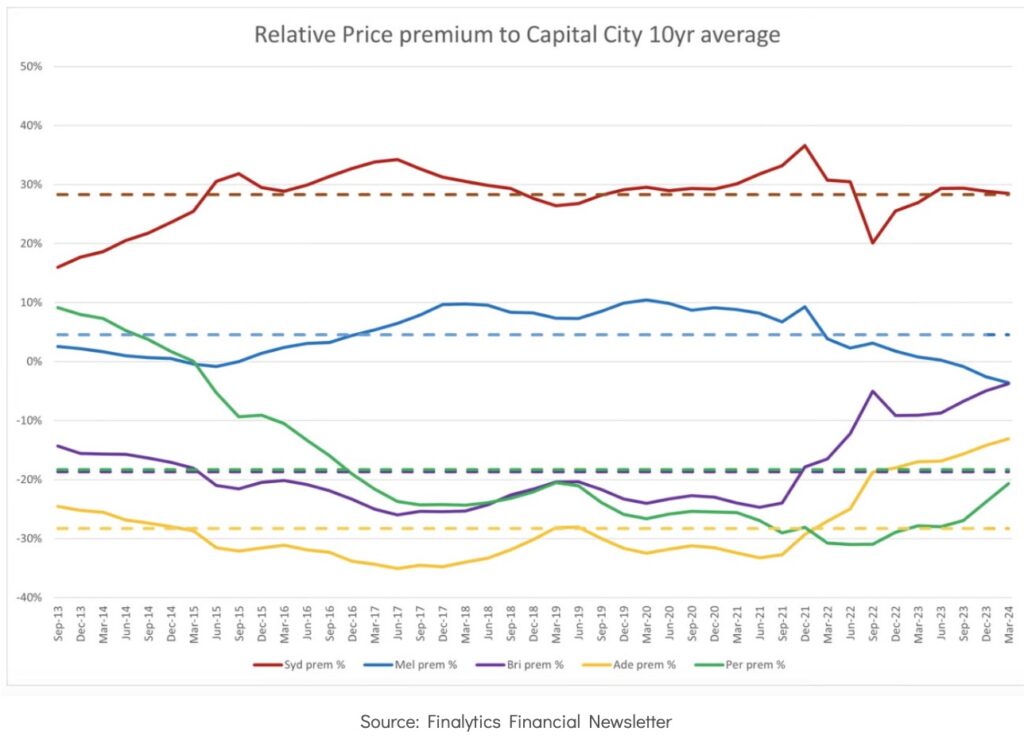

The land tax and rental reforms have discouraged some investors, but not all. The rate of interstate enquiry is increasing anecdotally as investors see increasing value in Melbourne. This chart below was featured in an earlier blog, illustrating the relative price premium to capital city ten year average. The blue line (Melbourne) shows a relative underperformance when contrasted against a long term average.

Many investors of late have been encouraged to speculate about Melbourne’s potential for growth based on the disparity between this ratio.

Mean reversion is another term for this approach. “Mean reversion in finance suggests that various relevant phenomena such as asset prices and volatility of returns eventually revert to their long-term average levels.” (Source: Investopedia)

While many may follow this theory, I don’t support it on its own. In tandem with other factors though, it will play a role in Melbourne’s recovery. The perception of value counts for a lot, as does sentiment.

I believe that other changes need to occur for Melbourne’s capital growth to reach double digit growth again. An obvious change would be that of increased financial capacity. This could come in two forms; either increased wage growth or an increase in borrowing capacity. The former is far more likely in my view, and it could be borne from either interest rate cuts, or a decrease in the lender’s buffer rates.

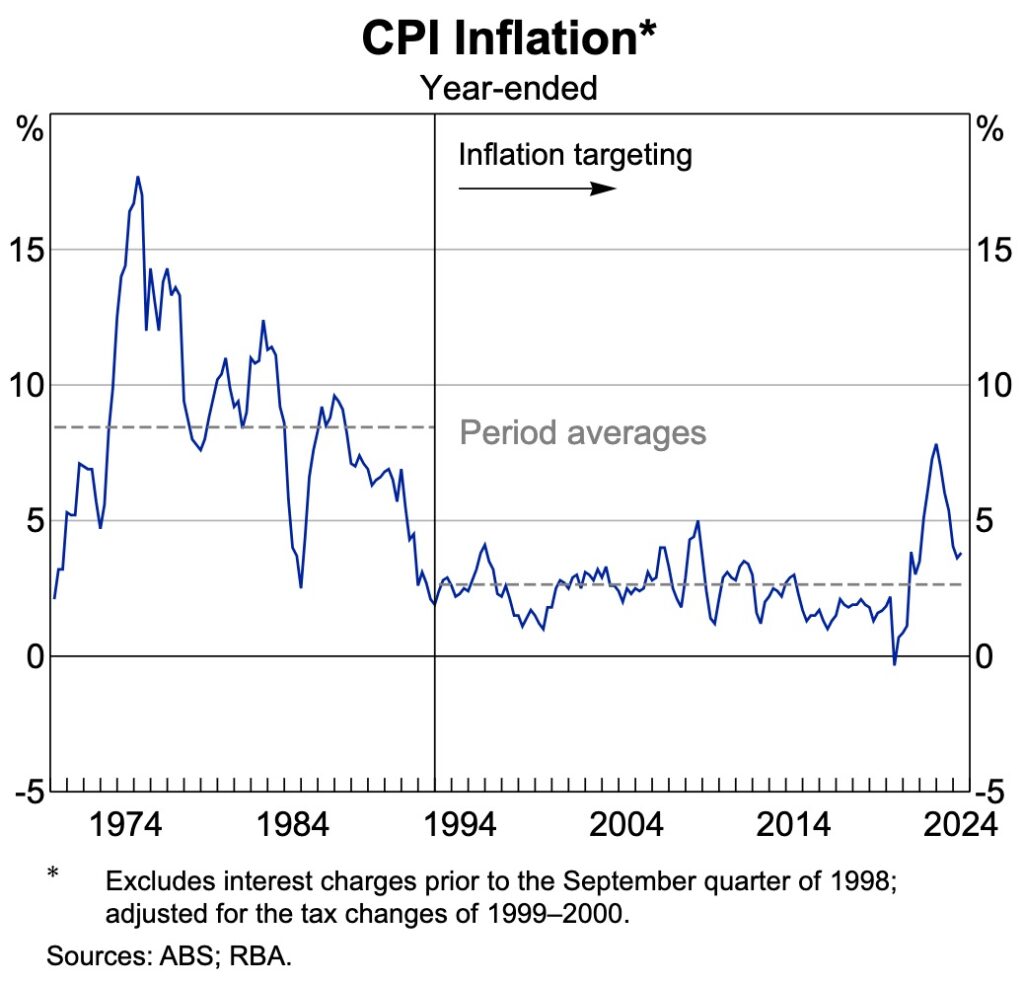

Interest rate cuts have been speculated upon for many months now. While our Reserve Bank Board Governor continues to remind us that our inflation rate is not within the 2-3% target, it is encouraging to see how it has reduced of late. This chart below provides some context for those who don’t remember (or weren’t around) for the 70’s and 80’s inflation woes.

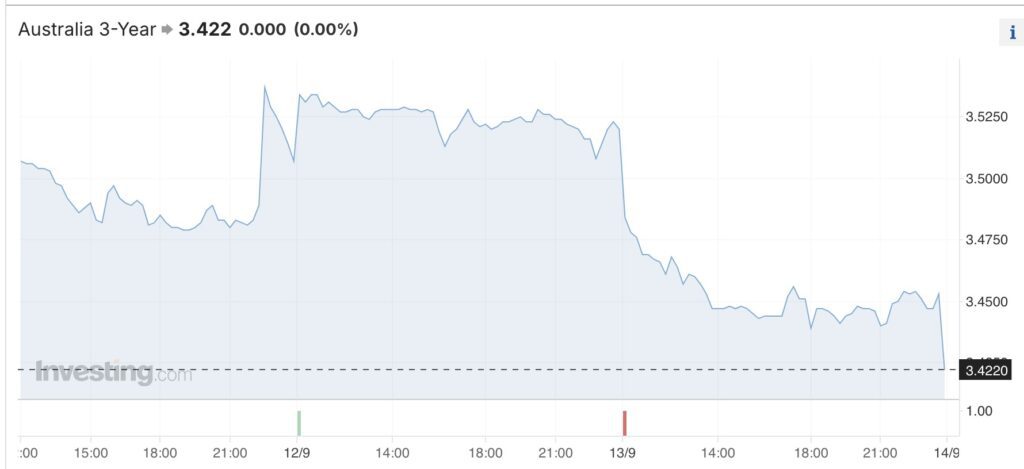

However, economists (and markets for that matter) anticipate a rate cut is still likely in 2025. The three year bond yields currently indicate this likelihood also.

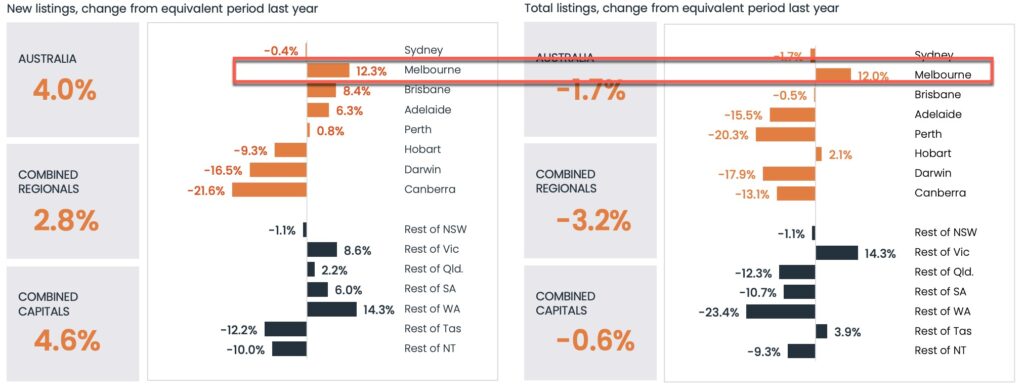

An increase in demand is an obvious growth driver. With housing starts relatively subdued and population growth underpinned by our migration policy, it is likely that pressure on housing will increase in time. We have seen a flurry of investor-led sales, and once this wave of investor sales settle, its likely that Melbourne’s sales volumes will return to historical averages.

Another change that could influence our market conditions relates to government policy and/or incentives. It is unlikely that this will occur while we continue to grapple with high inflation, however.

And the last significant change that could impact sentiment and confidence relates to a change of government for Victoria. While Saturday 28th November 2026 is a long way away, sentiment counts for a lot.

We all saw what the impact of Bill Shorten’s proposed changes to negative gearing policy did to our markets. And he didn’t even get elected, yet sentiment completely impacted our property market in the year leading up to the federal election in 2019.

When it comes to property markets, sentiment counts for so much.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU