We are all familiar with the theory of social proof. Everyone else is doing it, so it must be good.

When it comes to property, there are multiple ways that social proof can strike. Sometimes it will completely foil a good plan. When it comes to real estate, social proof is a far bigger threat in a buyer’s market than a seller’s market.

In a seller’s market, a buyer who falls prey to social proof risks overpaying. While this could spell financial pain, the chances are reasonably low. Unless the property is then sold a short time later, (i.e. within five years), the buyer is unlikely to experience a loss. Another negative outcome associated with overpaying is a valuation shortfall. This is stressful for any buyer, but in a normal auction environment it would be unusual for a lender’s valuer to suggest a lower value applies.

The biggest ‘social proof’ risk in a seller’s market is that the buyer purchases a poor quality property, or one that is not suitable for their needs.

However, in a buyer’s market, social proof stands to derail a good strategy and a great opportunity.

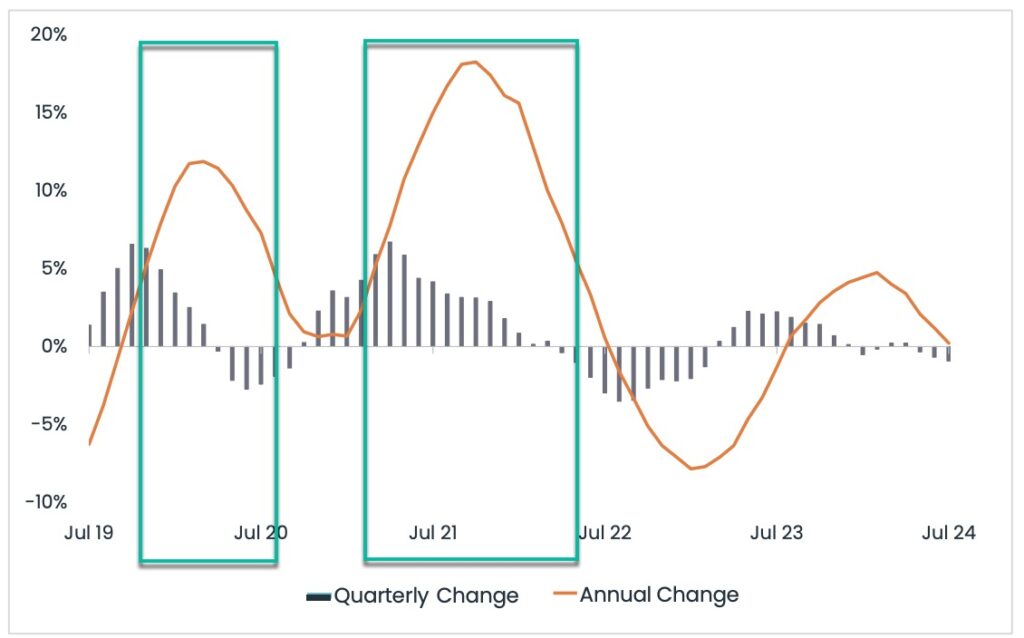

A buyers market ensues when supply exceeds demand. Or when buyers hold an advantage over sellers. Melbourne has offered buyer’s market conditions now for around two years. Values have been relatively static, and buyers have broadly enjoyed less competition and longer days on market. One of the benefits has been longer periods of time for buyers to conduct their due diligence. But the significant benefit relates to opportunity.

Buyers have had better opportunity to secure a high quality property with less competition. Unlike many of the other capital cities, buyers have not had to pay the same premiums to secure good stock.

Of course, the hallmark of a buyer’s market is less buyers. With less buyers comes lower auction clearance rates, longer days on market, more discounting, and a higher chance of a pass-in at auction.

When a property passes in, buyers can often ask themselves whether there is a flaw that they may have missed. They will almost certainly question (and reduce) the price limit that they were prepared to pay for the property.

When a private sale property sits on the market for weeks on end, the same issue can strike. Buyers can talk themselves out of making an offer on the property, but it’s not surprising that the same buyers then feel a rush of panic when another buyer comes along. It’s very common for other buyers to come out of the woodwork when a languishing property finally receives an offer.

People assume the agent is bluffing, but in many cases, it’s social proof at work.

The reason why social proof is far more dangerous in a buyer’s market relates to inaction. Those who sit back, waiting for the bell to market to heat up are willing the market to become a seller’s market again.

If we recall heady times when capital growth rates reached double digits, the conditions were tough for buyers. Buyers were flocking to auctions in droves. Prices were soaring, and many buyers were priced out of suburbs that they could have afforded a year prior.

The risk of letting social proof bite in a buyer’s market is significant. If capital growth reaches ten percent in a short period, could this derail a buyer’s plans? Lost opportunity is one of the biggest regrets when it comes to real estate.

Back in 2021, every buyer was begging the market to slow down. Now it has.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU