Twenty years ago I took a fortnight’s leave from my corporate job to map out a property investment strategy for my husband and I. We had investments between us, but we hadn’t really devised a strategy. We’d each taken snippets of advice and information and when we got together, our investments were diverse and not all were optimal. Our biggest challenge, however was that of borrowing capacity. We had purchased a lovely property to live in, but our ability to purchase more property at the time was limited.

I was thirty by this stage. I knew that I couldn’t amass a portfolio on the salary I was on if I didn’t reshape my investment approach. We made the bold decision to sell our little home, rent-vest, and use our capital by distributing it into several deposits. Our loan to value ratios on some of our loans were high but our approach was one of determination. Given cashflow was important to bolster my ability to borrow and buy more, I initially focused on locations that fit the following requirements;

- Sub-$80,000 price points

- Gross rental yield greater than 10%

- Population above 20,000

- Local and state government investment in the region

- A reasonable driving distance from Melbourne; we agreed that a same-day drive was tolerable. This criteria point was based on our ability to service any serious maintenance issues ourselves, without the need to find a local carpenter and/or project manager

After distilling a few locations, we decided on Port Pirie as our first stop. This regional city is the eighth largest city in South Australia and is just shy of three hours’ drive from Adelaide. Port Pirie, (or ‘Pirie’ as the locals call it) is home to the largest lead smelter in the southern hemisphere. The state government had budgeted to invest in the smelter upgrades and despite the smelter representing a large share of the employment sector, the healthcare share was encouraging for us as investors too.

Our plan was to drive over for an overnight stay to conduct a reconnaissance trip.

I’d paved out an itinerary and we inspected around ten properties. The rental returns cited were astounding and I cross-checked them with two property managers in town. We sat in the local pub with our counter meals in front of us, noting pro’s and cons of each shortlisted property and running the numbers on my borrowing capacity calculator. Determining that we could secure five properties with the five small deposits funded from the proceeds of our sale, we bought three in Pirie that weekend. The following two were to be in Frankston a few weeks later in an effort to round out our portfolio with some stronger capital growth alternatives.

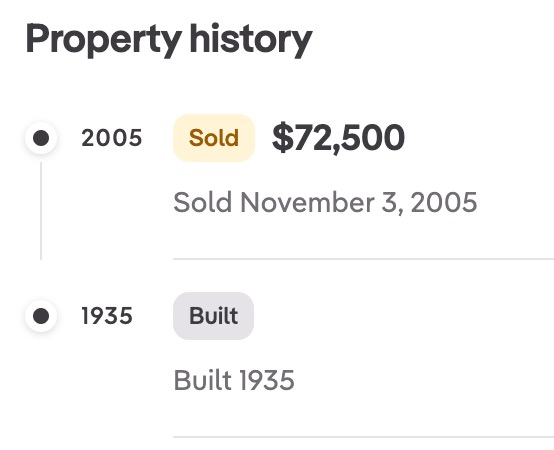

The first house we secured was this little cottage above. I secured it for $72,500 and we tripped it back across the border on a long weekend with the trailer rigged to paint and present it for lease. It leased almost immediately for $155pw following our weekend working bee. The other two properties had similar price points and rental yields. We secured each for $70,000 and $73,000 respectively. The difference between them however was the building materials. The brick properties also responded well to our cosmetic tidy-ups.

Little did we know that Pirie had a nice surprise in store for us.

Shortly after those purchases, Olympic Dam at Roxby Downs had some major expansion plans announced. Within months, the area received a glut of employees. Serious numbers of workers needed housing, but Roxby had insufficient capacity. Many turned to Pirie to either rent or buy, and our properties’ value uplift was almost immediate. We had purchased in this town for yield, but our equity growth was far higher than we’d anticipated. Subsequent acquisitions came sooner and our portfolio grew.

Fast forward 19 years, and our acquisition phase is over. We had always planned on holding all of our assets and retiring the debt so that we could enjoy a retirement income of rental proceeds. However, one thing we didn’t consider at the time was maintenance and the impact it could have on us as a family when the travelling distance is so great. Having a handy husband is advantageous until the maintenance issues and renovation projects separate you for weeks or months.

We made the decision to divest the two interstate weatherboard properties in our portfolio and reinvest the funds in shares. The property sold recently for $210,000.

This represents an average 5.8% annualised capital growth rate.

Considering we had bought these properties for rental yield, the capital growth was a pleasant surprise. Our basis for targeting high yield properties was twofold; to build up our rental income in retirement with unencumbered properties, and to bolster up our borrowing capacity for future acquisitions.

Risk must always be carefully understood when selecting smaller cities. Over-exposure to one dominant employer can be dangerous, and a deeper understanding of the business metrics of such employers is required. Port Pirie has been a great city for our relatively small capital investment, and it’s testament to the ability of an investor to identify areas that can deliver a balance of growth and yield.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU