This week’s blog is delivered following popular demand.

Many consumers misunderstand the interest rate news right now, and there are two common elements that are getting confused;

- interest rate increases: currently only fixed rates, not variable rates

- increased buffer rates, as initiated recently by APRA

Back to the first point…. So many people are feeling a degree of concern about the possibility of interest rate rises, and those who are concerned tend fall into one of two categories.

Some are worried that interest rate rises could destabilise the market and precipitate negative market movement, (ie. value losses). Those who speculate that this outcome is likely may choose to put their buying plans on hold in an effort to time the market and nab a bargain.

The issue that speculators who try to time markets face is that of getting it wrong. If the markets continue to move in an upward trajectory, they could face being priced out of a suburb and/or dwelling type that they could have afforded in today’s market.

Early 2021 taught us that.

So many speculators made the decision to put their property buying plans on hold until March 2021 in an effort to capitalise on the talked-about market deterioration that the end of JobKeeper would cause. However, it didn’t happen. The market strengthened and capital growth rates across most cities, (capital and regional) peaked following this key date.

The other common consumer concern relates to decreased borrowing capacity impacting buyers’ short term plans to purchase. In other words, many buyers who have extended themselves with credit pre-approval to the extent of their borrowing capacity are concerned that the restrictions on their top line bidding limits will preclude them from buying a property that they are confident they can comfortably afford.

While many people would hold a more cautious view, it is understandable why some buyers hold this concern.

It is important to note that that APRA’s most recent intervention with this effective macro-prudential tool has not impacted interest rates.

The intervention relates to buffer interest rates, and there is a big difference.

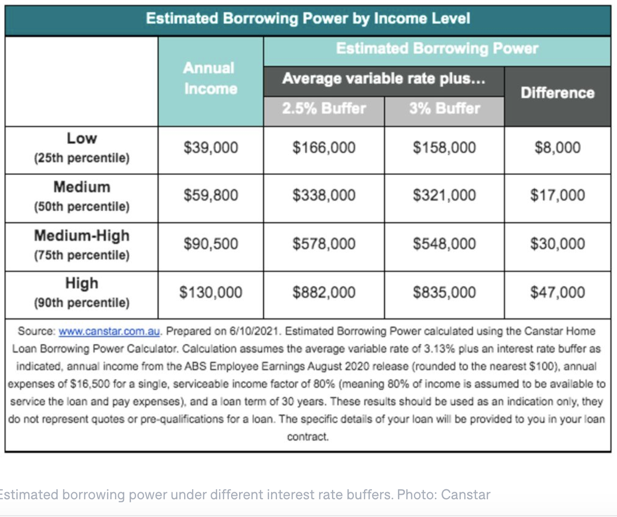

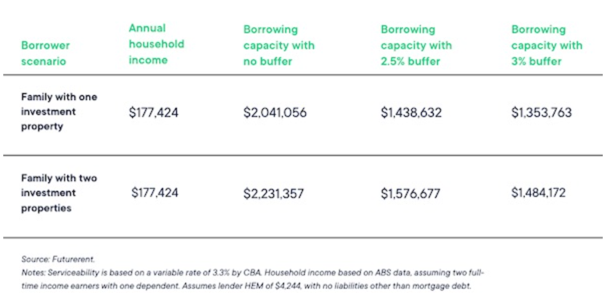

Our regulator made the decision very recently to increase the buffer rate from 2.5% to 3%. The buffer rate is the interest rate that the lenders calculate a borrower’s application for housing credit at. This buffer rate is significantly higher than the actual rate.

If a lender’s interest rate sits a 3% for example, the calculation of minimum monthly repayments is stress-tested now to 6% for the borrower. While the actual rate is unchanged, the projected repayment rate is now higher, which in turn reduces a borrower’s maximum borrowing capacity.

The types of buyers who are most impacted by this implementation are those who have multiple lending obligations, (typically multi property investors), and those home buyers who have extended themselves to their maximum borrowing capacity and are equity or asset-backed, (as opposed to first home buyers who are prepared to borrow at their maximum borrowing capacity, but are not asset backed). This latter point is important to note, as many first home buyer’s borrowing capacity is constrained by the size of their deposit, not the amount of debt that they could potentially service.

This following chart from Futurerent demonstrates the differential for investor scenarios. Interestingly the non-buffer borrowing capacity shows a clear contrast.

Consumers have overlooked the fact that our pre-2019 buffer rates sat well above 7%.

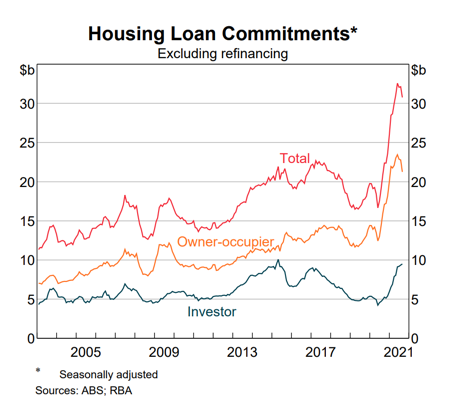

It was the easing of credit policy after our last market downturn, (triggered by the combination of restricted credit, shadow Federal government proposed tax changes, and the Banking Royal Commission) in tandem with record low interest rates that opened the flood gates for buyer activity in the Australian housing market.

Even with the recent +0.5% buffer rate increase, our buffer rates are nowhere near where they were two years ago.

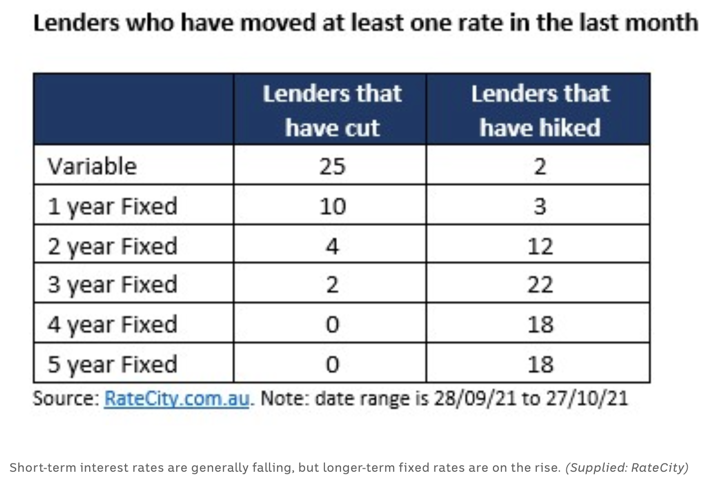

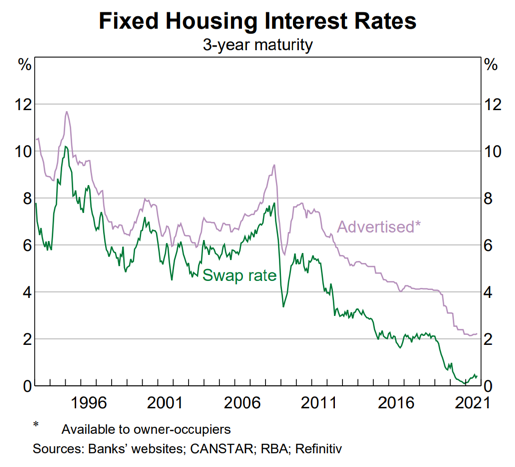

The next point to clarify relates to the dual speed of interest rate movement. Our variable interest rates have remained reasonably unchanged, (with a quiet murmur of small increases in line with banks costs of funding). However it is our fixed interest rates that are now on the move. It is important for consumers to recognise the difference between these two types of interest rates.

Fixed interest rates are essentially pre-purchased funds. Their cost varies based on the fixed interest term and the time that the bond was purchased.

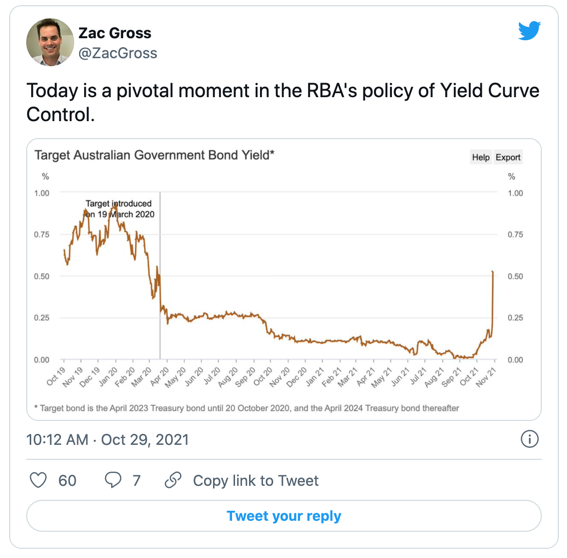

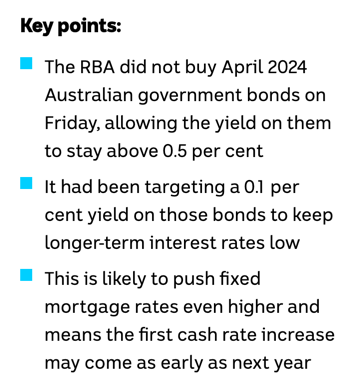

The RBA purchase varying volumes of Government bonds regularly, and the cost, tenure and volume purchased has a direct relationship to the fixed interest rate. The recent decision to purchase less bonds was noteworthy, and as this tweet below highlights, it was indeed a pivotal moment in the finance market.

“The Reserve Bank has been targeting that April 2024 government bond, which is a key benchmark interest rate, to push longer-term interest rates down through a mechanism known as “yield curve control” (YCC).

That has been a key part of its current commitment to record low interest rates now and out until “at least” 2024.

This commitment, or “forward guidance” as it is known on the markets, is a major reason why Australians enjoyed some of the lowest fixed mortgage rates they have ever seen earlier this year.

However, those ultra-cheap longer-term fixed loans have already been disappearing as global markets noted rising inflation across most of the world and started betting that central banks will begin lifting interest rates earlier than previously thought.” (Source: ABC)

What we can expect is a continued increased in fixed interest rates. We must also prepare for a cash rate increase earlier than previously expected.

Our regulator has no intention to see the Australian property market crash however, and RBA monthly meetings constantly focus on all market indicators in an effort to maintain a sustainable rate of growth for our property markets, among many economic factors and other markets.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU