We are often asked about capital growth by prospective investors and clients. Nobody can accurately pinpoint exactly how a property’s future performance will track, but thorough regression analysis can give us some insight into the impact of certain variables when it comes to tracking past performance. For example, location, or dwelling type.

What we do know is that in many postcodes, houses have outperformed units. And we also know that in many postcodes, period houses have outperformed younger houses.

Today’s blog captures the relationship between four of Geelong’s prized suburbs, and focuses on four period houses and their past sales.

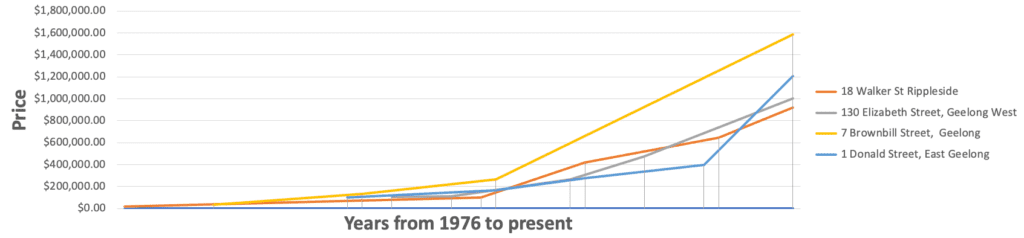

Tracking the historical sales data, we can illustrate the powerful growth story that Geelong presents for this dwelling type.

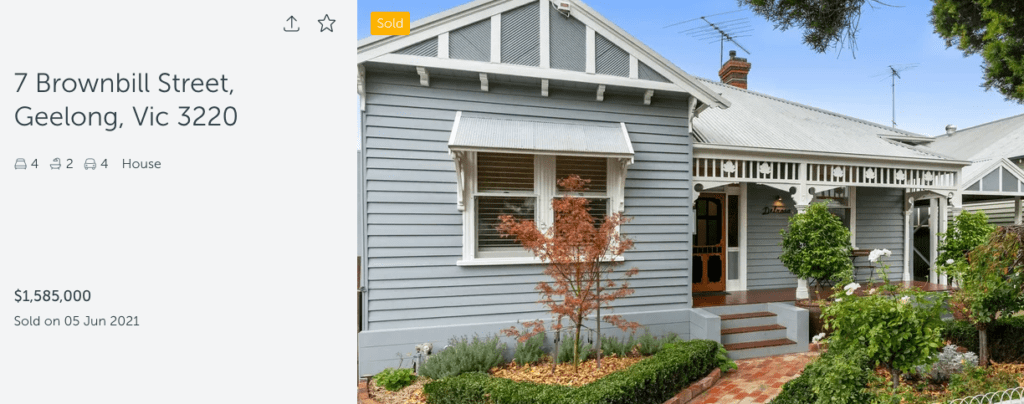

Yesterday’s big auction result at 7 Brownbill Street prompted this article.

The eased lockdown conditions for our regional cities enabled the scheduled auction to go ahead onsite, albeit filmed and streamed to the anxious Melbourne buyers who intended to bid.

COVID-19 lockdown didn’t seem to phase prospective buyers much, and some nine bidders battled for the keys on one of our coldest days yet this year.

The hammer fell to a bidder in the crowd after some Melburnians fought it out online in painful one thousand dollar increments, and on the 73rd bid, the property was sold for $1,585,000.

Beautifully presented and superbly located, this four bedroom family home was a perfect sample to study as a capital growth performer.

Capturing the past sales data back to 1982, this property does tell a great story. No doubt improved and renovated over the years by it’s various stakeholders, the impressive growth is evident when we chart the sales history.

7 Brownbill Street has delivered an average capital growth return of 10% over the last forty years.

This retrospective glance got me thinking about some of the other premium locales in Geelong, and more specifically, similar period houses.

We gathered three other sets of data to chart; and one in particular showed an interesting point. The properties we selected are as follows;

This superb Bungalow sold earlier this year in arguably one of Geelong’s most underrated suburb; a tiny pocket north of of the city called Rippleside; sitting proud atop Corio Bay and surrounded by local parks.

Defiantly close to busy Church Street, this beautiful Bungalow in ever-popular Geelong West sold earlier this year also.

Both houses exhibited ample past sale data points to be labelled compelling examples of consistent growth.

Each demonstrate an average long term capital growth rate of 9% per year.

Yellow, orange and grey represent Brownbill, Walker and Elizabeth respectively, (above).

The last sample relates to a house that had a significant renovation conducted between the past two sale data points. It serves as an interesting reminder when it comes to timing a capital injection and the avoidance of over-capitalisation.

We circled in on 1 Donald Street, East Geelong. This pretty period home had a stunning renovation undertaken following its 2015 campaign. The property was in need of a significant renovation and sadly our buyer’s savings on hand would not have been feasible for the work required at the time.

Up until this period, however the property’s prior sale data points indicated an annualised capital growth rate of only 6%.

The facade was enchanting but the floor plan deserved a reconfiguration; no small task for a first home buyer with tight cash on hand.

The owners took on a significant renovation and extension, opening up the rear of the house, reconfiguring the old dining room to an additional bedroom, introducing a fabulous master and ensuite to the side of the property and adding considerable depth to the rear dwelling boundary.

Such a renovation would have required a significant capital investment when factoring in development applications, design, building and landscaping.

The property sold earlier this year for $1.209M, and when plotted on the chart, a capital growth rate of just above 8.5% long term is calculated. However, factoring in the cost of the renovation, this may not have ended well if the property was sold shortly afterwards. Over-capitalisation would have indeed posed a risk for the two or so years following the renovation, when our market wobbles of 2018 impacted many property markets, Geelong included.

Surprisingly, this house underperformed the others above and it begs the question why?

East Geelong is beautiful, but it was the last of the four suburbs listed above to commence its recent gentrification growth trajectory.

East Geelong has many valuable elements to ensure its continued capital growth, and it is our belief that beautiful character homes in and around central Geelong will continue to be long term, star performers.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU