While there are many individuals and households that have been negatively impacted financially by COVID-19, there are also plenty who haven’t been adversely affected. In fact, some businesses and sectors are thriving as a result of the new demands that the pandemic has placed on their skillsets or businesses.

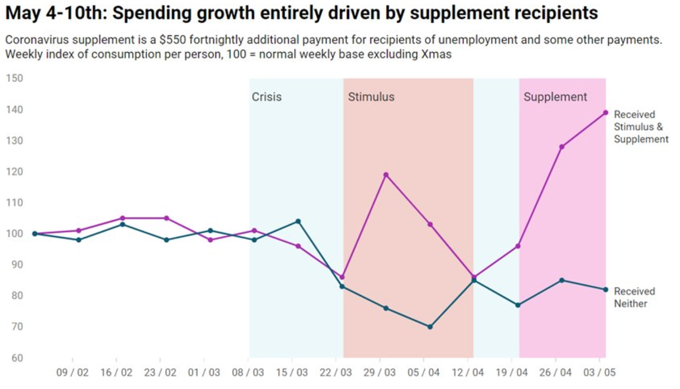

Our Government aggressively stepped in with assistance measures, some more regarded by economists than others. But it is fair to say that the Corona Virus Supplement payments applied to JobSeeker in tandem with both the JobKeeper assistance package, the stimulus payments and the Crisis payments for impacted Australians had the immediate effect intended.

As Morrison said in March, “It is about a cash injection into the Australian economy, which supports small businesses and supports medium businesses.”

From the moment the pandemic hit our shores, stockpiling and desperate ‘panic-buying’ of essentials plagued our supermarkets. As this pic, (courtesy of ABC) shows, our shelves were stripped bare of a variety of household items, namely toilet paper, pasta, rice, eggs and flour.

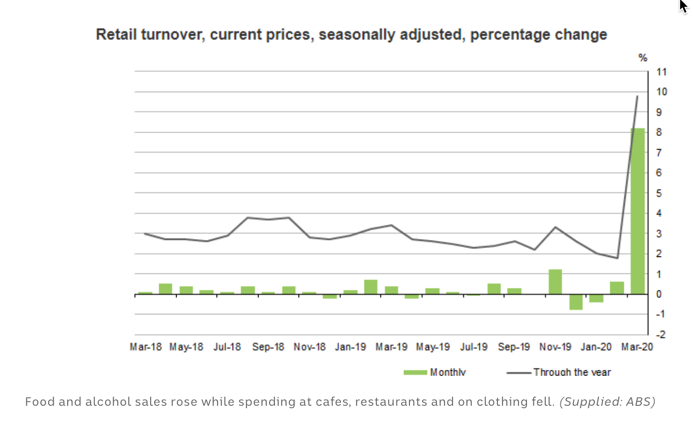

March retail sales spiked dramatically as consumers made frenzied attempts to stockpile around the nation. Retailers introduced purchase limits on specific products and social challenges arose, some of which security guards were employed to deal with.

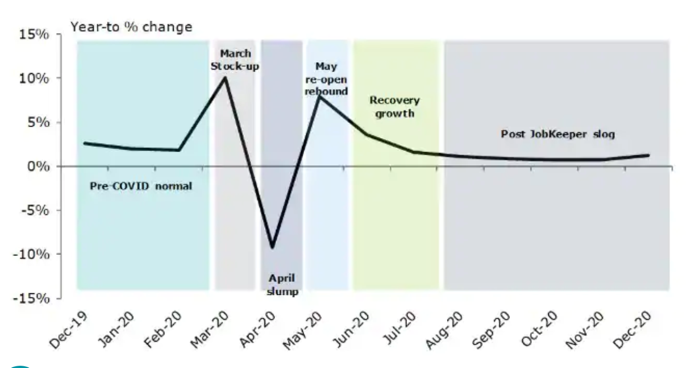

Unsurprisingly, once our lockdown measures increased, April’s slump was a stark contrast to the heightened panic-buying days of March.

“Retail turnover fell by more than $5.3 billion (17.7%) over April in seasonally adjusted terms, and was down 9.18% year-on-year.”according to Australian Bureau of Statistics (ABS).

As this chart shows, the May rebound was surprisingly strong. Deloitte’s projection will likely not match reality now that Melbourne, (and parts of NSW) have experienced a strong wave of reinfection and businesses have yet again been challenged with further lockdown Stage 3 measures for metro Melbourne and the Mitchell Shire. The extension of payments to JobSeeker recipients recently announced by our Federal Government will thwart the much-talked about ‘post JobKeeper September slog’ theory.

Whether our government’s extension of the JobKeeper initiative staggers the risk of such a ‘slog’, or kicks the can down the road is yet to be seen.

What is evident at the coalface for me, however is the difference between perceived buyer sentiment in Melbourne this lockdown period versus last March/April. Buyer enquiry is still relatively strong, clients have not opted to ‘pause’ their search this time round, (not one client has requested a rest) and buying activity still matches May and June. Prices haven’t notably softened, nor have we received landlord phone calls about tenants in distress.

This time feels different.

The changes to JobKeeper may influence the timing of some buyer actions in the property market. For those who were keen to ‘wait it out’ for September, when seasonal stock levels ordinarily increase with spring sunshine, (and in line with when their predictions about JobKeeper doom), their foresight could have aligned the planets to spell a bargain-buying opportunity. However, now they are now faced with a longer time frame to contemplate their purchase.

Do they wait until March 2021, or do they just jump in and buy now?

It’s an interesting human behaviour that will no doubt be answered in the coming weeks by others like myself who work at the coalface.

What we have observed more recently is an appreciation of domestic travel, and more to the point, weekender bliss. From an uptake in demand for local Air BnB properties to domestic holiday plans later in the year, it is evident that our travel itch as a nation is alive and well. Trying to book a week in the Margaret River, WA over Christmas holiday break is near-on impossible and comes with an enormous price tag.

And our client enquiry for holiday homes, (both coastal and country) has been exponential.

This raises the question of wealth and where it has traditionally been spent when holiday activity is considered. When I look at the sheer number of Aussie travellers and where we head, it’s a startling graphic.

Prior to COVID we had some 6.5 million Aussies travelling abroad in one year.

“Australians spent $65B on overseas holidays last year, and international visitors spent $45B in Australia.”

The Guardian, June 20

This is a vast differential, and one that could take many by surprise. Now that border closure limits our travels, we have to consider the changes that the travel industry will face, and moreso, what the travel-related cash distribution will look like in our economy, (including the real estate market).

The question is burgeoning.

What will the well-travelled Aussies choose to do with this spare cash while they have imposed overseas travel restrictions?

Right now it is a fair assumption that domestic travel will flourish again, holiday hotspots will attract locals, weekender escapes will be all-the-more appreciated, and with the Federal government’s latest talk of a new domestic travel incentive, we can anticipate a positive change for our tourism industry.

Our tourism businesses need it, that’s for sure. All we need to do now is manage our active COVID cases, unlock our borders and try to adjust to our new normal. No mean feat, but something we all look forward to.

In the meantime, I’ll be paying close attention to sales data, median house price changes and days on market for holiday hotspot locations.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU